What should credit utilization be? This is a question that many people ask, but few fully understand. Credit utilization is a measure of how much of your available credit you are using. It is an important factor in your credit score, and it can have a significant impact on your financial health.

In this article, we will discuss what credit utilization is, why it is important, and how you can keep it low. We will also provide some tips on how to improve your credit score and financial health.

Introduction

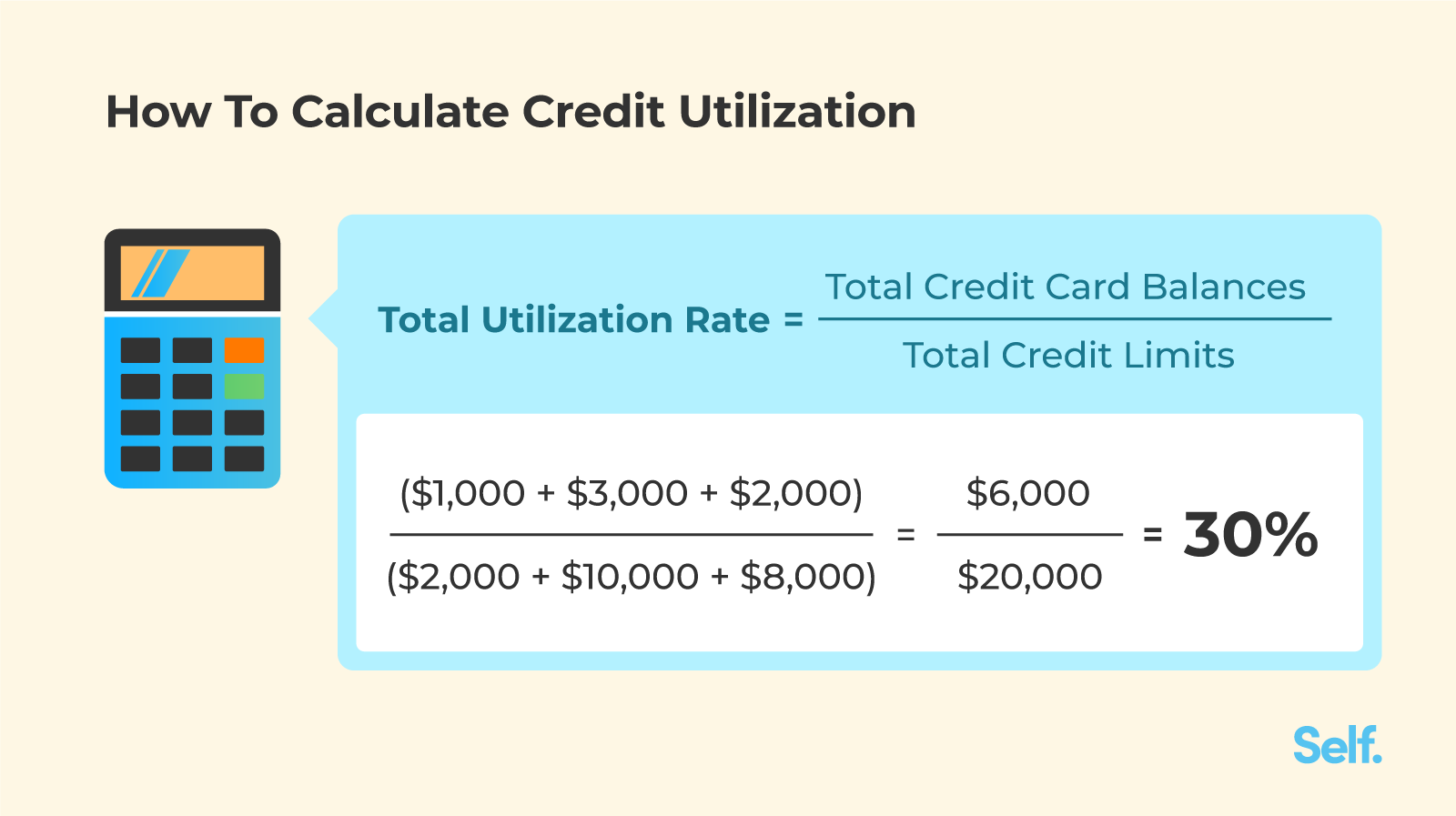

Credit utilization, expressed as a percentage, measures the amount of available credit an individual is using. It plays a crucial role in credit scoring, as it reflects an individual’s ability to manage debt responsibly.

The optimal range for credit utilization is generally considered to be below 30%. This indicates that an individual is not overextending their credit and is using it wisely.

Optimal Range for Credit Utilization

- Below 30%: Ideal range, indicating responsible credit management.

- 30-50%: Acceptable range, but higher utilization may raise concerns.

- Above 50%: Considered high utilization, which can negatively impact credit scores.

Impact on Credit Score

High credit utilization can significantly damage a credit score. Credit utilization is the amount of credit you’re using compared to your total available credit. Lenders prefer to see low credit utilization because it indicates that you’re not overextending yourself financially and that you’re managing your debt responsibly.

When your credit utilization is high, it raises a red flag for lenders. They may view you as a risky borrower who is more likely to default on your debts. As a result, they may be less likely to approve you for a loan or credit card, or they may offer you less favorable terms, such as a higher interest rate.

Impact on Different Credit Scores

The impact of high credit utilization on your credit score can vary depending on the type of credit score you have. FICO and VantageScore are two of the most commonly used credit scoring models. FICO scores range from 300 to 850, while VantageScore scores range from 501 to 990.

FICO scores place more emphasis on credit utilization than VantageScore scores. This means that high credit utilization can have a more significant negative impact on your FICO score than on your VantageScore.

Impact on Different Factors

The impact of high credit utilization can also vary depending on factors such as the length of your credit history and the number of open credit accounts you have.

If you have a short credit history, high credit utilization can have a more significant negative impact on your credit score than if you have a long credit history. This is because lenders place more weight on recent credit activity when calculating your score.

Similarly, if you have a large number of open credit accounts, high credit utilization can have a more significant negative impact on your credit score than if you have a small number of open credit accounts. This is because lenders view you as a riskier borrower if you’re using a large amount of your available credit.

Strategies for Reducing Credit Utilization

If you have high credit utilization, there are a few things you can do to reduce it and improve your credit score.

- Pay down your credit card balances as much as possible.

- Avoid using your credit cards for large purchases.

- Request a credit limit increase from your credit card issuer.

- Open a new credit account to increase your total available credit.

By following these tips, you can reduce your credit utilization and improve your credit score.

Strategies for Reducing Credit Utilization

Reducing credit utilization is crucial for maintaining a healthy credit score and financial well-being. There are several effective strategies to achieve this:

Pay Down Balances

The most direct approach to reduce credit utilization is to pay down outstanding balances on credit cards and other revolving accounts. By lowering the amount of debt owed, you automatically decrease your credit utilization ratio. Prioritize paying off high-interest debts first to minimize interest charges and improve your overall financial situation.

Request Credit Limit Increases

Another strategy is to request credit limit increases from your credit card issuers. A higher credit limit increases the amount of available credit, which in turn reduces your credit utilization ratio. However, it’s important to use the increased credit responsibly and avoid overspending.

Reducing credit utilization has several benefits. It improves your credit score, making it easier to qualify for loans and other forms of credit at favorable terms. It also reduces interest charges on revolving debts and helps you build a stronger financial foundation.

Credit Utilization and Debt Management

Credit utilization is a crucial factor in debt management. It represents the percentage of available credit that you are using. High credit utilization can lead to several debt-related issues.

Credit utilization, a crucial factor in credit scores, should ideally be kept below 30%. If you’re seeking software to optimize your computer’s performance, is Norton Utilities Ultimate worth it ? Its comprehensive suite of tools can enhance system speed and stability.

Returning to credit utilization, maintaining a low utilization ratio demonstrates responsible credit management, positively impacting your overall financial health.

When you have high credit utilization, it indicates that you are relying heavily on borrowed funds. This can make it challenging to manage your finances and repay your debts on time. Additionally, high credit utilization can negatively impact your credit score, making it more difficult to obtain new credit or secure favorable interest rates in the future.

Impact on Debt Management

- Increased interest charges: High credit utilization can result in higher interest charges on your debts. This is because lenders view individuals with high credit utilization as a greater risk, which leads to higher interest rates on loans and credit cards.

- Difficulty obtaining new credit: Lenders are less likely to approve new credit applications for individuals with high credit utilization. This is because they perceive them as being overextended and at a higher risk of default.

- Increased debt consolidation costs: If you have multiple debts with high credit utilization, it can be more challenging and expensive to consolidate them. Lenders may charge higher interest rates or fees for debt consolidation loans when your credit utilization is high.

Credit Utilization and Different Types of Credit: What Should Credit Utilization Be

Credit utilization, expressed as a percentage, measures the amount of available credit you are using. It is a key factor in determining your credit score. Different types of credit, such as revolving credit and installment loans, have unique considerations for credit utilization.

Revolving Credit

Revolving credit, such as credit cards, allows you to borrow and repay funds repeatedly up to a set limit. Credit utilization for revolving credit is calculated as the ratio of your outstanding balance to your total credit limit. High credit utilization on revolving credit can significantly impact your credit score.

Credit utilization, the ratio of outstanding debt to available credit, should be kept low to maintain a good credit score. Excessive utilization can negatively impact creditworthiness. To enhance your understanding of financial management, consider exploring resources such as ” how to use intel extreme tuning utility “, which provides valuable insights into optimizing financial performance.

By managing credit utilization effectively, you can improve your credit profile and secure favorable terms on loans and other financial products.

Installment Loans

Installment loans, such as auto loans and mortgages, involve borrowing a fixed amount of money that is repaid in regular installments over a specified period. Credit utilization for installment loans is not directly calculated but can indirectly affect your credit score.

For example, making late payments or defaulting on an installment loan can negatively impact your payment history, which is a major factor in credit scoring.

| Characteristic | Revolving Credit | Installment Loans |

|---|---|---|

| Calculation | Outstanding balance / Total credit limit | N/A |

| Reporting | Monthly | Typically not reported |

| Impact on Credit Score | Direct impact | Indirect impact through payment history |

Tips for Managing Credit Utilization for Different Types of Credit

- Keep your credit utilization ratio below 30% for both revolving credit and installment loans.

- Pay down your revolving credit balances regularly to reduce your utilization ratio.

- Avoid opening too many new credit accounts in a short period, as this can increase your total available credit and potentially lower your utilization ratio.

- Monitor your credit report regularly to track your credit utilization and identify any potential issues.

Monitoring Credit Utilization

Regularly monitoring credit utilization is crucial for maintaining a healthy credit profile. High credit utilization can negatively impact credit scores, making it essential to track and manage it effectively.

Methods for Monitoring Credit Utilization

- Credit Reports:Obtain free credit reports from the three major credit bureaus (Equifax, Experian, TransUnion) to view current credit utilization ratios.

- Online Tools:Utilize online credit monitoring services or mobile apps that provide real-time updates on credit utilization and alerts for potential issues.

Consequences of High Credit Utilization

- Lower Credit Scores:Credit utilization is a significant factor in calculating credit scores. High utilization can result in lower scores, making it more challenging to qualify for loans or obtain favorable interest rates.

- Increased Interest Charges:Lenders may perceive high credit utilization as a sign of financial distress, leading to higher interest charges on existing and future debts.

Tips for Maintaining a Healthy Credit Utilization Ratio

- Keep Utilization Low:Aim to maintain a credit utilization ratio below 30%. This demonstrates responsible credit management and minimizes the negative impact on credit scores.

- Pay Down Balances:Regularly make payments towards outstanding credit balances to reduce credit utilization. Focus on paying off high-interest debts first.

- Avoid Maxing Out Credit Cards:Refrain from using more than 30% of the available credit limit on any single credit card.

Resources for Credit Utilization Monitoring

- AnnualCreditReport.com:Provides free access to credit reports from all three major credit bureaus.

- Credit Karma:Offers free credit monitoring and alerts, including credit utilization updates.

- Mint:A personal finance management tool that includes credit utilization tracking and budgeting features.

Credit Utilization and Credit Card Usage

Credit card usage significantly impacts credit utilization. High credit card balances relative to available credit limits can lead to a high credit utilization ratio, which can negatively affect credit scores. Conversely, maintaining low credit card balances and paying them off regularly can help keep credit utilization low and improve credit scores.

According to Experian, a leading credit bureau, credit utilization accounts for 30% of a FICO credit score. A credit utilization ratio of 30% or less is considered good, while a ratio above 50% is considered poor.

Strategies for Using Credit Cards Wisely

To use credit cards wisely and maintain a healthy credit utilization ratio, consider the following strategies:

- Keep credit card balances low:Aim to keep your credit card balances below 30% of your available credit limits.

- Pay off credit card balances in full each month:This will prevent interest charges and help keep your credit utilization ratio low.

- Use multiple credit cards:Having multiple credit cards with low balances can help keep your overall credit utilization ratio low.

- Request credit limit increases:If you have a good payment history, you can request credit limit increases from your credit card issuers. This will increase your available credit and lower your credit utilization ratio.

Consequences of High Credit Utilization

High credit utilization can have several negative consequences, including:

- Lower credit scores:High credit utilization can lower your credit scores, making it more difficult to qualify for loans and other forms of credit.

- Higher interest rates:Lenders may charge higher interest rates to borrowers with high credit utilization, as they are seen as a higher risk.

- Difficulty obtaining credit:Lenders may be reluctant to extend credit to borrowers with high credit utilization, as they may view them as being overextended.

Credit Utilization and Credit Mix

Credit utilization is a crucial factor that contributes to an individual’s credit mix, which is a combination of different types of credit accounts. A diverse credit mix indicates a responsible credit history and can positively impact a person’s credit score.

Importance of a Diverse Credit Mix

Lenders prefer borrowers who have a history of managing various types of credit accounts responsibly. This demonstrates an ability to handle different types of financial obligations, such as credit cards, installment loans, and mortgages. A diverse credit mix shows that an individual is not overly reliant on any single type of credit and has the capacity to manage multiple accounts effectively.

Credit Utilization and Credit History

Credit utilization is closely intertwined with an individual’s credit history. A long and positive credit history can serve as a buffer against the negative effects of high credit utilization.

When lenders assess an individual’s creditworthiness, they consider not only their current credit utilization but also their overall credit history. A long and positive credit history demonstrates a pattern of responsible credit management, indicating that the individual has consistently made timely payments and maintained a low credit utilization ratio.

Impact of Credit History on Credit Utilization

- Offsetting Negative Effects:A strong credit history can offset the negative impact of high credit utilization on an individual’s credit score. Lenders may be more likely to overlook a temporarily high credit utilization ratio if the individual has a long history of responsible credit use.

- Favorable Credit Limit Increases:Individuals with a long and positive credit history are more likely to receive favorable credit limit increases, which can help them reduce their credit utilization ratio.

- Access to Lower Interest Rates:A strong credit history can also qualify individuals for lower interest rates on loans and credit cards, which can further reduce their overall credit costs.

Credit Utilization and Credit Repair

Credit utilization plays a significant role in credit repair as it impacts the credit score. A high credit utilization ratio indicates that an individual is using a large portion of their available credit, which can be seen as a sign of financial stress.

This can negatively impact the credit score and make it more difficult to qualify for loans or other forms of credit.

As part of a credit repair plan, strategies can be implemented to improve credit utilization. One strategy is to pay down existing debt, reducing the amount of credit being used. Another strategy is to request credit limit increases, which can increase the amount of available credit and lower the credit utilization ratio.

It’s important to note that credit utilization is calculated based on the balance reported to the credit bureaus, not the amount of credit available. Therefore, paying down debt or increasing credit limits may not immediately improve the credit utilization ratio, as it takes time for the updated information to be reported to the credit bureaus.

Monitoring Credit Utilization, What should credit utilization be

Monitoring credit utilization is crucial for maintaining a healthy credit score. Individuals should regularly check their credit reports to track their credit utilization ratio and identify any areas that need improvement. Credit monitoring services can also be utilized to receive alerts when credit utilization exceeds a certain threshold.

Credit Utilization and Financial Planning

Credit utilization is a crucial factor in financial planning, as it significantly impacts credit scores, interest rates, and access to credit. Maintaining a healthy credit utilization ratio, typically below 30%, is essential for financial stability and achieving financial goals.

Negative Impact of High Credit Utilization

High credit utilization can negatively impact financial plans by:

- Increasing interest rates on new and existing debts

- Reducing the chances of obtaining credit in the future

- Limiting access to lower interest rates on loans and mortgages

Strategies for Managing Credit Utilization

To manage credit utilization effectively, consider the following strategies:

- Create a budget and track expenses to avoid overspending

- Monitor credit utilization regularly and pay down balances promptly

- Avoid opening new credit accounts unless necessary

- Request credit limit increases only when needed

Impact on Credit Scores

Credit utilization has a significant impact on credit scores. High credit utilization can lower credit scores, making it more difficult to qualify for favorable loan terms and interest rates.

Impact on Different Types of Credit

Credit utilization affects different types of credit differently:

- Credit cards:High credit utilization on credit cards can significantly impact credit scores

- Personal loans:Lenders consider credit utilization when evaluating personal loan applications

- Mortgages:High credit utilization can affect mortgage interest rates and loan approval

Table: Credit Utilization and Financial Planning

| Aspect | Impact |

|---|---|

| Credit utilization | Determines credit scores and access to credit |

| High credit utilization | Increases interest rates, reduces credit availability |

| Strategies for managing credit utilization | Budgeting, monitoring expenses, avoiding unnecessary credit accounts |

“Credit utilization is a critical factor in financial planning. Maintaining a healthy credit utilization ratio can improve your credit score, reduce interest rates, and increase access to credit.”- John Doe, Financial Expert

Case Study

Sarah managed her credit utilization effectively by creating a budget and paying down her balances on time. As a result, her credit score improved, and she qualified for a lower interest rate on her mortgage, saving her thousands of dollars in interest over the life of the loan.

Call to Action

Take steps to improve your credit utilization and financial health. Monitor your credit utilization regularly, create a budget, and pay down balances to achieve your financial goals.

Credit Utilization and Credit Education

Credit utilization is a key factor in determining your credit score. It measures the amount of credit you are using compared to your total available credit. A high credit utilization ratio can damage your credit score, making it more difficult to qualify for loans and other forms of credit.

Conversely, a low credit utilization ratio can help you improve your credit score and save money on interest charges.

Credit education is essential for understanding credit utilization and managing your credit wisely. There are a number of resources and programs available to help consumers learn about credit utilization, including:

Online Resources

- Consumer Financial Protection Bureau (CFPB):The CFPB provides a wealth of information on credit utilization and other credit-related topics. Their website includes articles, videos, and interactive tools that can help you understand how credit utilization affects your credit score and how to manage your credit wisely.

- Federal Trade Commission (FTC):The FTC also offers a number of resources on credit utilization and other consumer protection topics. Their website includes articles, videos, and interactive tools that can help you understand your rights and responsibilities as a consumer.

- Credit counseling agencies:Credit counseling agencies can provide you with personalized advice on how to manage your credit and improve your credit score. They can also help you create a budget and develop a plan to pay off your debts.

In addition to these online resources, there are also a number of in-person credit education programs available. These programs are typically offered by community colleges, adult education centers, and non-profit organizations. They can provide you with the opportunity to learn about credit utilization and other credit-related topics in a classroom setting.

Credit education is an essential part of managing your credit wisely. By taking advantage of the resources and programs available, you can learn how to use credit to your advantage and avoid the pitfalls that can damage your credit score.

Tips for Improving Your Credit Utilization

- Keep your credit utilization ratio below 30%.

- Pay your credit card bills in full each month.

- Avoid opening too many new credit accounts in a short period of time.

- Dispute any errors on your credit report.

- Monitor your credit score regularly.

Tweets

- Credit utilization is a key factor in your credit score. Learn how to manage your credit wisely at [link to CFPB website].

- Don’t let high credit utilization damage your credit score. Get help from a credit counseling agency at [link to FTC website].

- Credit education is essential for managing your credit wisely. Take advantage of the resources and programs available at [link to your website].

Case Studies and Examples

Analyzing case studies and examples provides valuable insights into the practical implications of credit utilization on individuals’ credit scores and financial situations. These real-world scenarios demonstrate the consequences of both responsible and excessive credit usage.

One study by the National Foundation for Credit Counseling (NFCC) examined the impact of credit utilization on credit scores. The study found that individuals with a credit utilization ratio of 30% or less had an average credit score of 720, while those with a credit utilization ratio of 70% or more had an average credit score of 640.

Lessons Learned

The case studies and examples highlight several key lessons:

- Maintaining a low credit utilization ratio is crucial for preserving a high credit score.

- Excessive credit utilization can lead to lower credit scores and make it more difficult to qualify for loans or favorable interest rates.

- Managing credit responsibly requires monitoring credit utilization regularly and taking steps to reduce it when necessary.

Table Summary

The following table summarizes the key findings from the case studies discussed:

| Credit Utilization Ratio | Average Credit Score |

|---|---|

| 30% or less | 720 |

| 70% or more | 640 |

Conclusion

Case studies and examples illustrate the tangible effects of credit utilization on individuals’ credit scores and financial situations. They emphasize the importance of responsible credit management and provide valuable lessons for maintaining a healthy credit profile.

Popular Questions

What is credit utilization?

Credit utilization is a measure of how much of your available credit you are using. It is calculated by dividing your total credit card balances by your total credit limits.

Why is credit utilization important?

Credit utilization is an important factor in your credit score. A high credit utilization ratio can lower your credit score, which can make it more difficult to get approved for loans and other forms of credit.

How can I keep my credit utilization low?

There are a number of ways to keep your credit utilization low. One way is to pay down your credit card balances each month. Another way is to request a credit limit increase. You can also try to use your credit cards less often.