What is a pre printed check – What is a pre-printed check? In the realm of financial transactions, pre-printed checks stand out as a convenient and secure method of payment, offering businesses and individuals alike a streamlined and efficient way to manage their finances. Join us as we delve into the intricacies of pre-printed checks, exploring their advantages, customization options, and best practices for usage.

Pre-printed checks are a valuable tool for businesses looking to save time and reduce errors in their check processing. They come pre-printed with essential information, such as the company name, address, and bank account number, eliminating the need for manual entry and reducing the risk of mistakes.

Define Pre-Printed Check

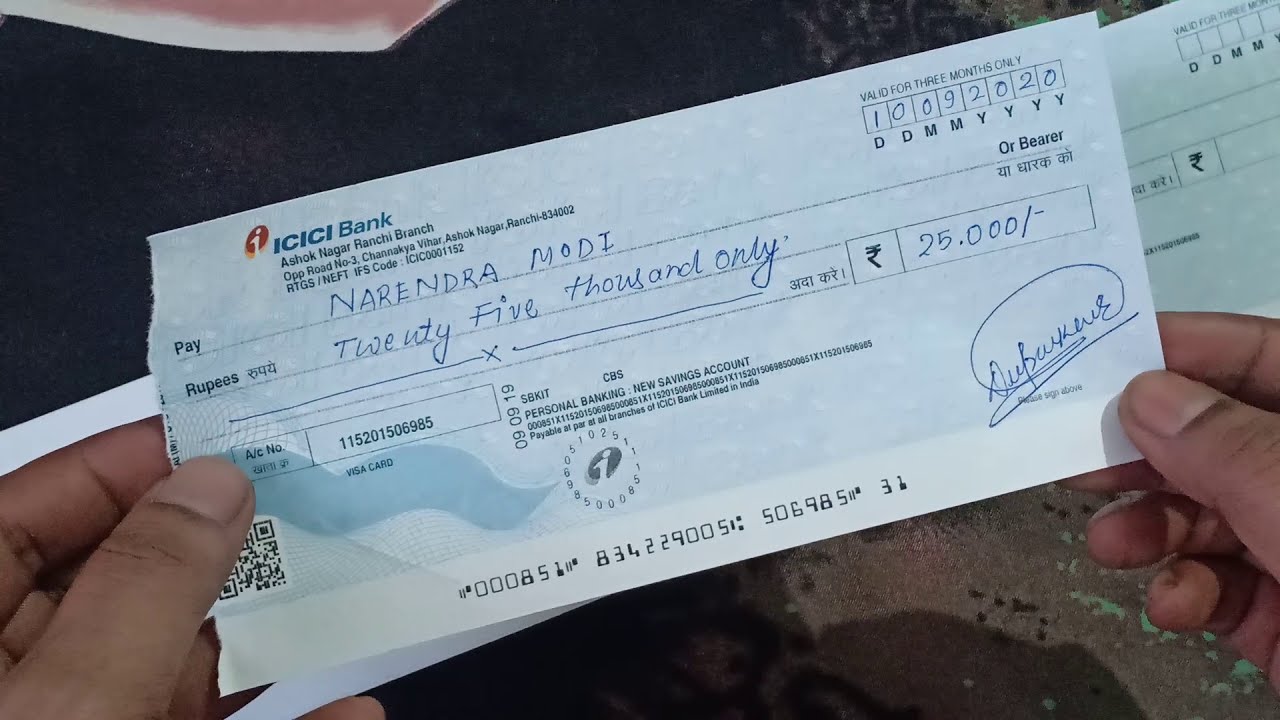

A pre-printed check is a type of check that has been printed in advance with the name, address, and account number of the payer.

A pre printed check is a check that has been printed with the payee’s name, address, and account number in advance. This can save time when writing checks, as you do not have to fill in this information each time.

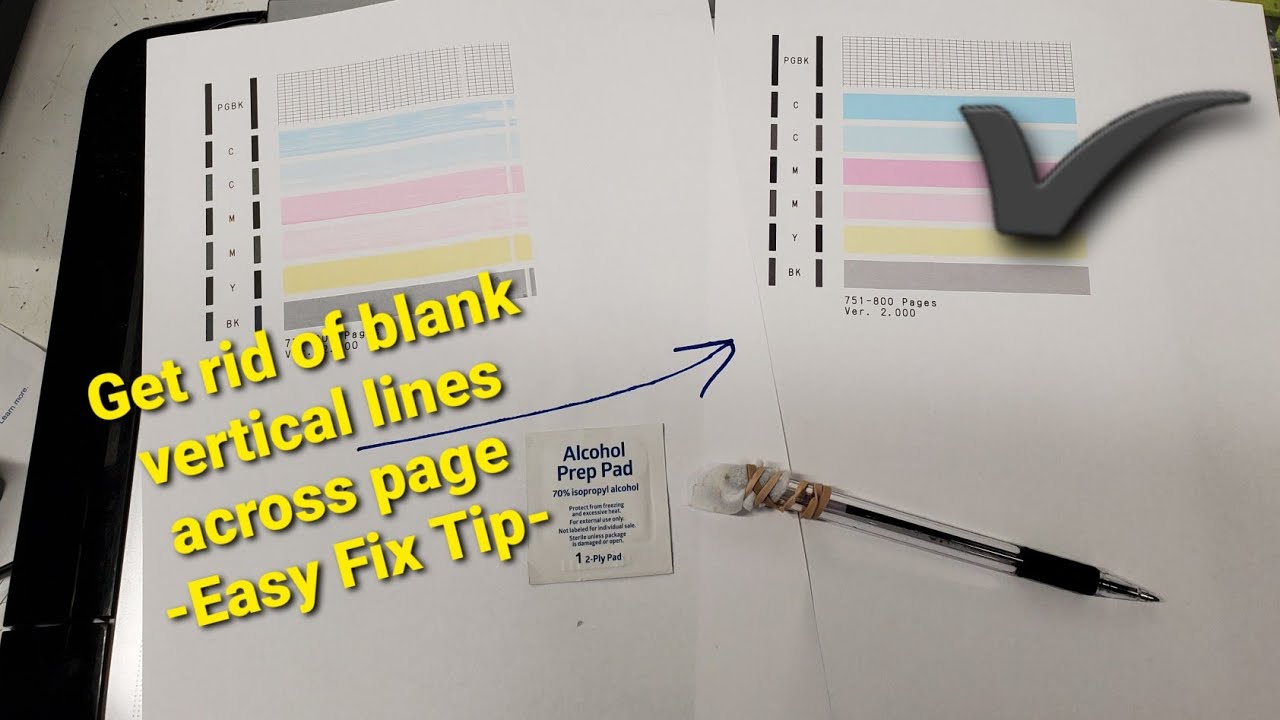

However, it is important to keep printer ink from drying out in order to ensure that the pre printed checks remain legible. One way to do this is to store the checks in a cool, dry place. You can also purchase special cartridges that are designed to prevent ink from drying out.

For more information on how to keep printer ink from drying out, visit this website. By following these tips, you can help to ensure that your pre printed checks remain in good condition.

Unlike blank checks, which require the payer to fill in all of the information each time they write a check, pre-printed checks can save time and reduce errors. They are also more secure than blank checks, as they are more difficult to forge.

Examples of Pre-Printed Checks and Their Uses

- Personal checks:Pre-printed personal checks are used by individuals to pay for everyday expenses, such as groceries, utilities, and rent.

- Business checks:Pre-printed business checks are used by businesses to pay for goods and services, such as inventory, supplies, and payroll.

- Payroll checks:Pre-printed payroll checks are used by businesses to pay employees their wages or salaries.

Benefits of Using Pre-Printed Checks

Pre-printed checks offer several advantages that can streamline financial processes and enhance efficiency.

One significant benefit of using pre-printed checks is the time savings they provide. By eliminating the need to manually write out each check, businesses and individuals can save a substantial amount of time, allowing them to focus on more critical tasks.

Improved Accuracy

Pre-printed checks help improve accuracy by reducing the likelihood of errors that can occur during manual check writing. The pre-printed information, such as the company name, address, and account number, is already printed on the check, minimizing the risk of incorrect data entry.

Features of Pre-Printed Checks

Pre-printed checks offer various standard features that enhance their functionality and security. These features ensure the checks are reliable, convenient, and secure for financial transactions.

Security features are crucial on pre-printed checks to prevent fraud and protect against unauthorized access. These features include watermarks, security threads, and microprinting, which make it difficult to replicate or counterfeit the checks.

A pre printed check is a check that has been printed with the payee’s name, address, and account number. This information is typically printed in magnetic ink character recognition (MICR) format, which allows the check to be processed by automated check processing systems.

To ensure that the MICR information is printed correctly, it is important to use a high-quality printer and to follow the manufacturer’s instructions. You can learn more about how to display non printing characters in word by clicking here.

Once the check has been printed, it can be signed and mailed to the payee.

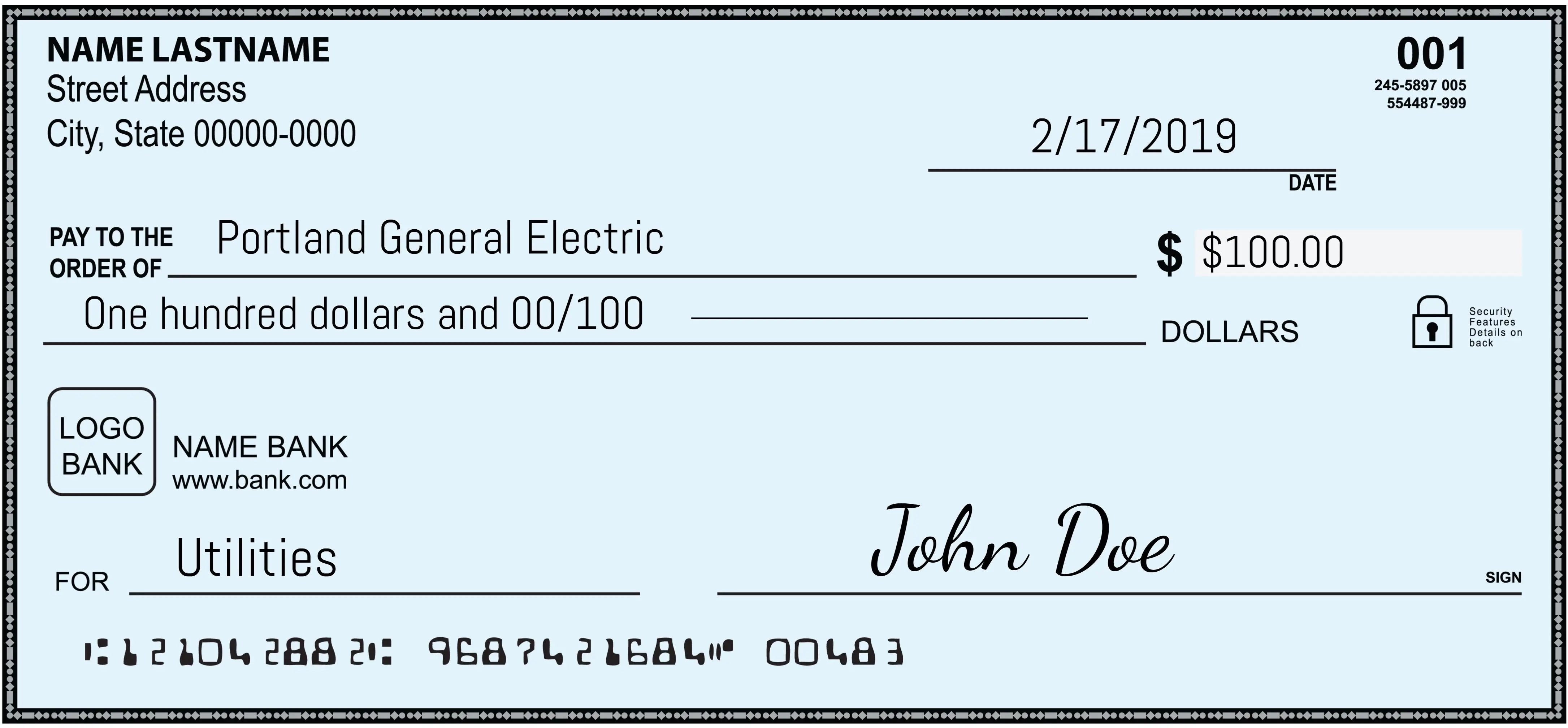

Standard Features

- Pre-Printed Information:Business name, address, and account information are pre-printed on the checks, eliminating the need for manual entry.

- Check Numbering:Each check has a unique sequential number for easy tracking and reconciliation.

- MICR Line:Magnetic Ink Character Recognition (MICR) line at the bottom of the check contains encoded information for automated processing.

- Signature Line:Designated area for the authorized signer to provide their signature.

- Amount Line:Space for writing the amount of the payment in both numerical and written formats.

Security Features

- Watermarks:Embedded designs or images that become visible when held up to light, making it difficult to duplicate.

- Security Threads:Thin, metallic threads woven into the paper, which glow or change color under ultraviolet light.

- Microprinting:Extremely small text or images printed on the check, which can only be seen under magnification, providing an additional layer of security.

- Chemical Protection:Special inks and coatings that resist alteration or erasure, protecting against fraud.

- Void Pantograph:A repeating pattern that appears when the check is photocopied, deterring unauthorized duplication.

Types of Pre-Printed Checks

Pre-printed checks are available in various types, each designed to meet specific business requirements. The key differences between these types lie in their security features, customization options, and intended uses.

Here are the most common types of pre-printed checks:

Security Checks

Security checks incorporate advanced security features to prevent fraud and counterfeiting. They typically include:

- Watermarks

- Holograms

- Microlines

- Void pantographs

These features make it difficult to alter or duplicate the checks, providing businesses with enhanced protection against financial losses.

Business Checks

Business checks are designed for everyday business transactions. They offer a professional appearance and include customizable features such as:

- Company logo and address

- Check number and date

- Payee line

- Signature line

Business checks are commonly used for vendor payments, employee salaries, and other routine business expenses.

Personal Checks

Personal checks are used by individuals for personal transactions. They are similar to business checks but may have less customization options and security features.

Blank Checks

Blank checks are checks without any pre-printed information. They provide maximum flexibility and can be customized on-demand using a check-writing software or a check-printing machine.

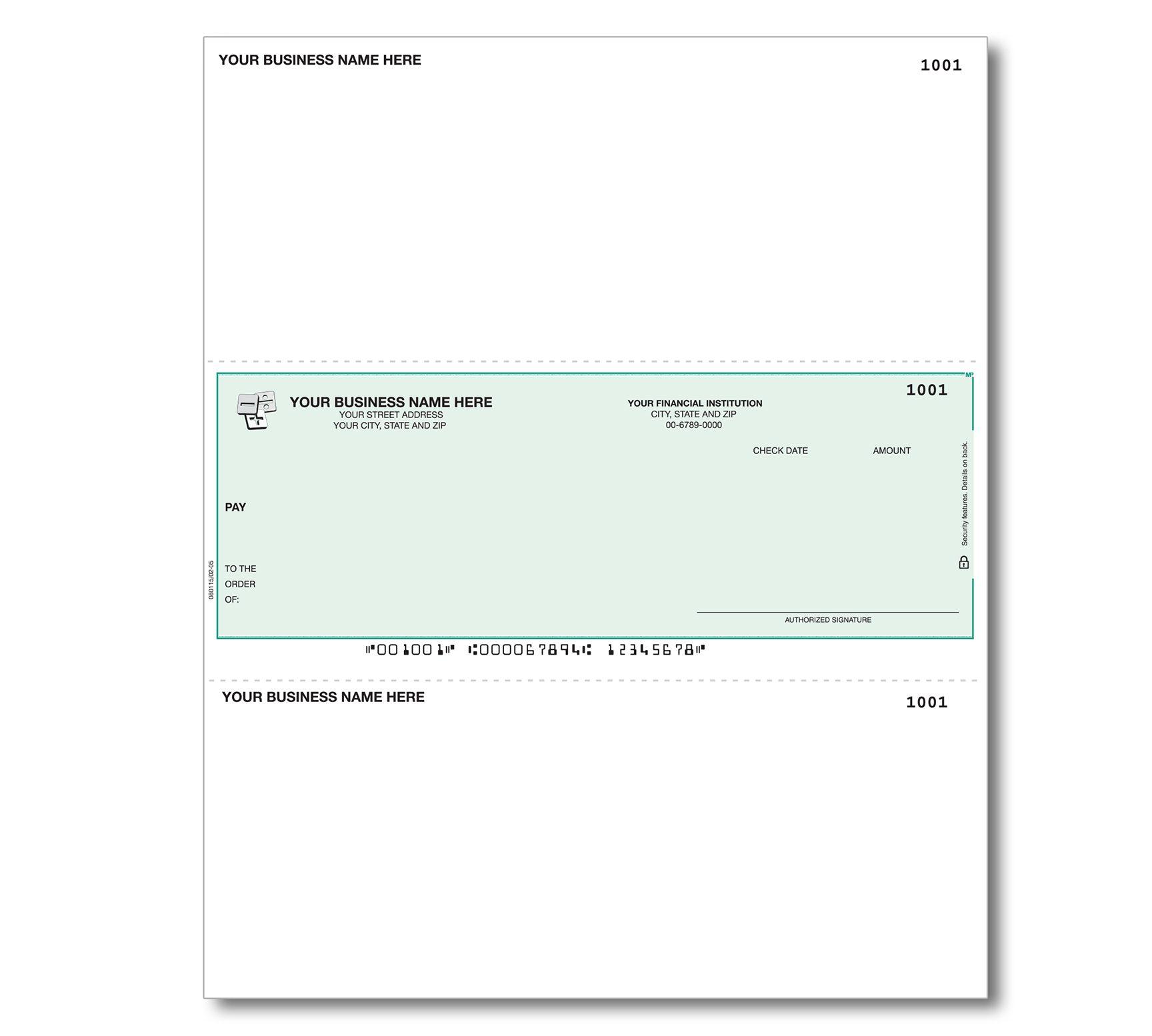

Laser Checks

Laser checks are designed to be printed using a laser printer. They are typically blank and can be customized with the necessary information using a computer and check-writing software.

Magnetic Ink Character Recognition (MICR) Checks

MICR checks have a special magnetic ink at the bottom of the check that contains encoded information. This information is used by banks for automated check processing, making it faster and more efficient.

| Type | Examples | Key Differences |

|---|---|---|

| Security Checks | Watermark checks, Hologram checks | Advanced security features to prevent fraud |

| Business Checks | Company logo checks, Address checks | Professional appearance, customizable features |

| Personal Checks | Individual name checks, Address checks | Less customization options, fewer security features |

| Blank Checks | No pre-printed information | Maximum flexibility, can be customized on-demand |

| Laser Checks | Designed for laser printers | Blank, can be customized using a computer |

| MICR Checks | Magnetic ink at the bottom | Automated check processing by banks |

Customization Options for Pre-Printed Checks

Pre-printed checks offer various customization options to meet the specific needs of businesses and individuals. These options allow users to personalize their checks with logos, signatures, and other details, enhancing both the professional appearance and security of the checks.

Customization options typically include:

Company Logos and Information

- Businesses can incorporate their company logos, names, and addresses on pre-printed checks to promote brand recognition and provide essential contact information.

Signatures

- Authorized signatories can have their signatures pre-printed on checks, streamlining the check-signing process and ensuring authenticity.

Security Features

- Pre-printed checks can incorporate security features such as watermarks, holograms, and microprinting to deter fraud and protect against counterfeiting.

Additional Customization

- Some providers offer additional customization options, such as custom fonts, colors, and borders, allowing businesses to create checks that align with their corporate identity and branding.

Ordering Pre-Printed Checks

Ordering pre-printed checks involves selecting a provider, customizing the design, and providing necessary information for production. Here’s a guide to help you through the process.

Factors to Consider

When ordering pre-printed checks, consider the following factors:

- Check Style:Choose from various check styles, such as business checks, personal checks, or computer checks.

- Security Features:Select checks with security features like watermarks, microprinting, and chemical protection to prevent fraud.

- Checkbook Type:Decide on the type of checkbook you need, such as a top-stub, side-stub, or wallet checkbook.

- Quantity:Determine the number of checks you require based on your usage.

- Delivery Time:Consider the delivery time to ensure timely receipt of your checks.

Steps Involved, What is a pre printed check

- Select a Provider:Research and choose a reputable check printing provider that offers the desired features and customization options.

- Design Customization:Provide the provider with your business logo, address, contact information, and any other customization requests.

- Provide Bank Account Information:Share your bank account information, including the routing and account numbers, for check production.

- Review and Approve:Carefully review the check design and account information before approving production.

- Production and Delivery:The provider will produce the checks and deliver them to your specified address within the agreed-upon time frame.

Key Points

Remember these key points when ordering pre-printed checks:

- Consider your specific needs and requirements.

- Choose a reliable provider with a proven track record.

- Provide accurate and complete information for check production.

- Review and approve the check design before finalizing the order.

- Track the delivery status to ensure timely receipt.

Using Pre-Printed Checks

:max_bytes(150000):strip_icc()/where-is-the-account-number-on-a-check-315278_final-30e94da21d1644329716939bef5107ac.png)

Pre-printed checks offer convenience and security for managing financial transactions. To use them effectively, follow these best practices:

Filling Out and Signing Checks

When filling out a pre-printed check, ensure the following:

- Write the date clearly in the “Date” field.

- Indicate the recipient’s name and the amount in both numbers and words.

- Sign the check legibly in the designated area.

Preventing Fraud and Forgery

To safeguard against fraud and forgery, take these precautions:

- Store checks securely in a locked place.

- Report lost or stolen checks immediately.

- Inspect checks carefully for any alterations or unauthorized additions.

Key Steps for Using Pre-Printed Checks

| Step | Action |

|---|---|

| 1 | Fill out the check with the required information. |

| 2 | Sign the check legibly. |

| 3 | Review the check for accuracy and completeness. |

| 4 | Protect the check from fraud and forgery. |

Common Mistakes to Avoid

- Leaving checks blank or unsigned.

- Filling out checks with incorrect information.

- Failing to secure checks properly.

- Not reporting lost or stolen checks promptly.

Did You Know?

Pre-printed checks have been used for centuries, with their origins dating back to the 18th century.

Glossary of Terms

- Check:A written order directing a bank to pay a specified amount of money to a named recipient.

- Pre-printed Check:A check that has been pre-printed with the bank’s name, account number, and other information.

- Payee:The person or entity to whom the check is made payable.

- Drawer:The person or entity who signs the check and orders the bank to make the payment.

– Security Risks Associated with Pre-Printed Checks

Pre-printed checks offer convenience and efficiency, but they also come with inherent security risks. Forgers and fraudsters can exploit vulnerabilities in the check system, leading to financial losses and reputational damage.

The primary security risks associated with pre-printed checks include forgery and counterfeiting, theft and unauthorized use, and data breaches.

Forgery and counterfeiting

Forgery involves altering or creating fake checks to deceive recipients into accepting them as genuine. Counterfeiting, on the other hand, refers to the production of exact copies of legitimate checks. Both forgery and counterfeiting can result in financial losses for businesses and individuals.

Theft and unauthorized use

Pre-printed checks can be stolen or fraudulently obtained and used for unauthorized transactions. This can lead to significant financial losses and identity theft.

Data breaches

Data breaches can expose sensitive information, such as account numbers and routing numbers, which can be used to create fraudulent checks or compromise financial accounts.

Comparison of Pre-Printed Checks to Other Payment Methods

Pre-printed checks offer several advantages and disadvantages compared to other payment methods. Understanding these differences can help businesses and individuals choose the most appropriate payment method for their specific needs.

Here’s a comparison of pre-printed checks with other payment methods:

Cash

- Pros:Widely accepted, anonymous, no transaction fees.

- Cons:Risk of theft or loss, difficult to track and reconcile, not suitable for large payments.

Credit Cards

- Pros:Convenient, widely accepted, rewards and benefits, easy to track and manage.

- Cons:Transaction fees, potential for fraud, can lead to overspending.

Electronic Payments

- Pros:Fast, secure, convenient, can be automated, lower transaction fees.

- Cons:May require special equipment or software, not universally accepted, can be vulnerable to cyber fraud.

Future of Pre-Printed Checks

In the digital age, the future of pre-printed checks is uncertain. As technology advances, electronic payment methods are becoming increasingly popular, leading to a decline in the use of traditional checks.

However, pre-printed checks still offer several advantages over electronic payments, including security, convenience, and cost-effectiveness. As a result, they are likely to continue to be used for certain types of transactions, such as high-value payments and payments to individuals or businesses that do not accept electronic payments.

Potential Impact of Technology

Technology is likely to have a significant impact on the use of pre-printed checks. The rise of mobile banking and digital wallets has made it easier than ever to make electronic payments. Additionally, new technologies such as blockchain and distributed ledger technology (DLT) are emerging that could further disrupt the traditional payment system.

These technologies could make it possible to create new types of digital checks that are more secure and convenient than traditional paper checks. For example, digital checks could be linked to a user’s digital identity, making it impossible to forge or counterfeit them.

Additionally, digital checks could be processed more quickly and efficiently than paper checks, reducing the risk of fraud and errors.

Design Principles for Pre-Printed Checks

Purpose of Design Principles in Pre-Printed Checks

Design principles play a crucial role in creating visually appealing and functional pre-printed checks. They ensure checks are easy to use, secure, and compliant with industry standards.

Guidelines for Creating Visually Appealing and Functional Checks

- Use clear and concise fonts.

- Incorporate ample white space for readability.

- Choose colors that enhance visibility and prevent counterfeiting.

- Align elements precisely for accuracy and professionalism.

Essential Elements on a Pre-Printed Check

- Company name and address

- Check number

- Date line

- Payee line

- Amount line

- Signature line

- MICR line

Security Features on Pre-Printed Checks

- Watermark

- Hologram

- UV-sensitive ink

- Microprinting

- Chemical protection

Legal Considerations for Pre-Printed Checks

Pre-printed checks carry legal implications that users must be aware of to ensure compliance with banking regulations and avoid potential liabilities.

Compliance with Banking Regulations

Banks have specific regulations regarding the use of pre-printed checks. These regulations typically cover aspects such as:

- Check size and format

- Font and font size

- Security features (e.g., watermarks, microprinting)

- Information required on the check (e.g., account number, routing number)

Failure to comply with these regulations may result in checks being rejected by banks, leading to delays in payments or even legal consequences.

Legal Liability

Pre-printed checks carry certain legal liabilities for both the issuer and the recipient. The issuer is responsible for ensuring the accuracy and authenticity of the check, while the recipient must exercise due diligence to verify the validity of the check before accepting it as payment.If a pre-printed check is forged or altered, the issuer may be held liable for any resulting financial losses.

Similarly, if the recipient accepts a forged or altered check, they may be responsible for any unauthorized withdrawals from their account.To mitigate legal risks, it is essential for businesses and individuals using pre-printed checks to implement robust security measures and follow best practices for check handling.

Case Studies of Pre-Printed Checks: What Is A Pre Printed Check

Pre-printed checks have been a valuable tool for businesses and individuals alike, offering numerous benefits such as increased efficiency, reduced costs, and enhanced security. Here are a few case studies that demonstrate the successful implementation of pre-printed checks:

Case Study 1: ABC Corporation

ABC Corporation, a medium-sized manufacturing company, was facing challenges with its check processing system. The manual process was time-consuming and error-prone, leading to delays in payments and increased costs. After implementing a pre-printed check system, ABC Corporation experienced a significant improvement in its check processing efficiency.

- Reduced time spent on check processing by 50%

- Eliminated errors associated with manual check writing

- Improved cash flow by ensuring timely payments to vendors and employees

Case Study 2: XYZ Nonprofit Organization

XYZ Nonprofit Organization was struggling to manage its donations effectively. The organization relied on handwritten checks, which were often illegible and prone to fraud. By switching to pre-printed checks, XYZ Nonprofit Organization gained greater control over its financial transactions.

- Increased security by preventing unauthorized access to blank checks

- Reduced the risk of fraud by using tamper-proof features

- Enhanced customer satisfaction by providing donors with professional-looking checks

Case Study 3: John Smith, Individual

John Smith, a self-employed contractor, was facing difficulties in managing his personal finances. He often overdrew his checking account due to errors in check writing. After using pre-printed checks, John Smith gained better control over his finances.

- Improved accuracy in check writing, reducing overdraft fees

- Increased convenience by having checks readily available

- Enhanced peace of mind by knowing that his checks are secure

FAQs about Pre-Printed Checks

.png?sfvrsn=bafa9180_0)

Pre-printed checks are a convenient and secure way to make payments. They are widely used by businesses and individuals alike. Here are some frequently asked questions about pre-printed checks, along with concise and informative answers:

What is the difference between a pre-printed check and a blank check?

A pre-printed check has the payee’s name, address, and account number printed on it, while a blank check does not. This makes pre-printed checks more convenient to use, as you do not have to fill in this information each time you write a check.

Are pre-printed checks safe to use?

Yes, pre-printed checks are safe to use. They are printed on high-quality paper that is difficult to counterfeit, and they include security features such as watermarks and microprinting. Additionally, most banks offer fraud protection for pre-printed checks.

How do I order pre-printed checks?

You can order pre-printed checks from your bank or from a check printing company. When ordering pre-printed checks, you will need to provide your bank account information, the payee’s name and address, and the quantity of checks you want to order.

Can I customize pre-printed checks?

Yes, you can customize pre-printed checks. You can choose the color, design, and font of the checks. You can also add your company logo or other graphics to the checks.

What are the benefits of using pre-printed checks?

There are many benefits to using pre-printed checks, including:

- Convenience: Pre-printed checks are more convenient to use than blank checks, as you do not have to fill in the payee’s name, address, and account number each time you write a check.

- Security: Pre-printed checks are more secure than blank checks, as they are printed on high-quality paper that is difficult to counterfeit and include security features such as watermarks and microprinting.

- Professionalism: Pre-printed checks give your business a more professional appearance than blank checks.

- Cost-effective: Pre-printed checks are a cost-effective way to make payments, as they are typically less expensive than blank checks.

Query Resolution

What are the advantages of using pre-printed checks?

Pre-printed checks offer several advantages, including saving time, reducing errors, enhancing security, and providing a professional appearance.

How can I customize pre-printed checks?

Pre-printed checks can be customized with your company logo, signature, and other unique elements to reflect your brand identity.

What security features are included in pre-printed checks?

Pre-printed checks often incorporate security features such as watermarks, holograms, and microprinting to prevent counterfeiting and fraud.

How do I order pre-printed checks?

You can order pre-printed checks online or through your bank. Be sure to provide accurate information and consider your check usage volume when placing your order.