What is a credit utilization rate? It’s a crucial factor in determining your creditworthiness and overall financial health. Understanding this concept is essential for managing your credit effectively and achieving your financial goals.

This comprehensive guide will delve into the intricacies of credit utilization rate, exploring its calculation, impact on credit score, and strategies for optimizing it. Whether you’re a seasoned credit user or just starting to build your financial foundation, this guide will empower you with the knowledge and tools to navigate the world of credit utilization.

Introduction

Credit utilization rate is a measure of how much of your available credit you are using. It is calculated by dividing your outstanding credit balances by your total credit limits. A high credit utilization rate can negatively impact your credit score, which can make it more difficult to qualify for loans and other forms of credit at favorable interest rates.

A good credit utilization rate is generally considered to be 30% or less. This means that you should not be using more than 30% of your total available credit. A bad credit utilization rate is considered to be anything above 30%.

Using more than 30% of your available credit can raise red flags for lenders, indicating that you may be overextended and at risk of default.

Calculating Credit Utilization Rate

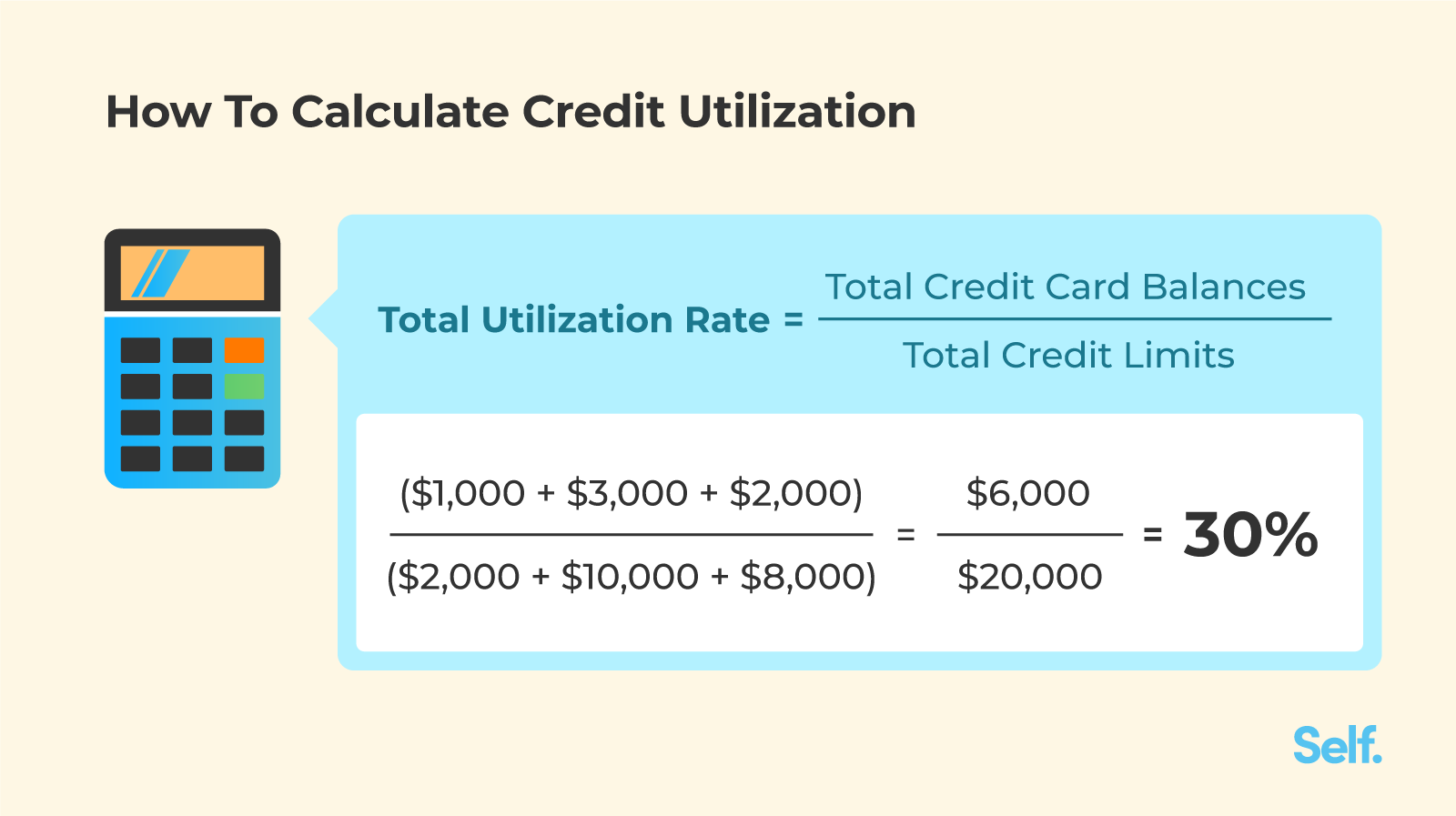

Credit utilization rate is a measure of how much credit you are using compared to your total available credit. It is calculated by dividing your total outstanding balance by your total available credit. A low credit utilization rate is generally considered to be a good thing, as it shows that you are not overextending yourself financially.

Formula for Calculating Credit Utilization Rate

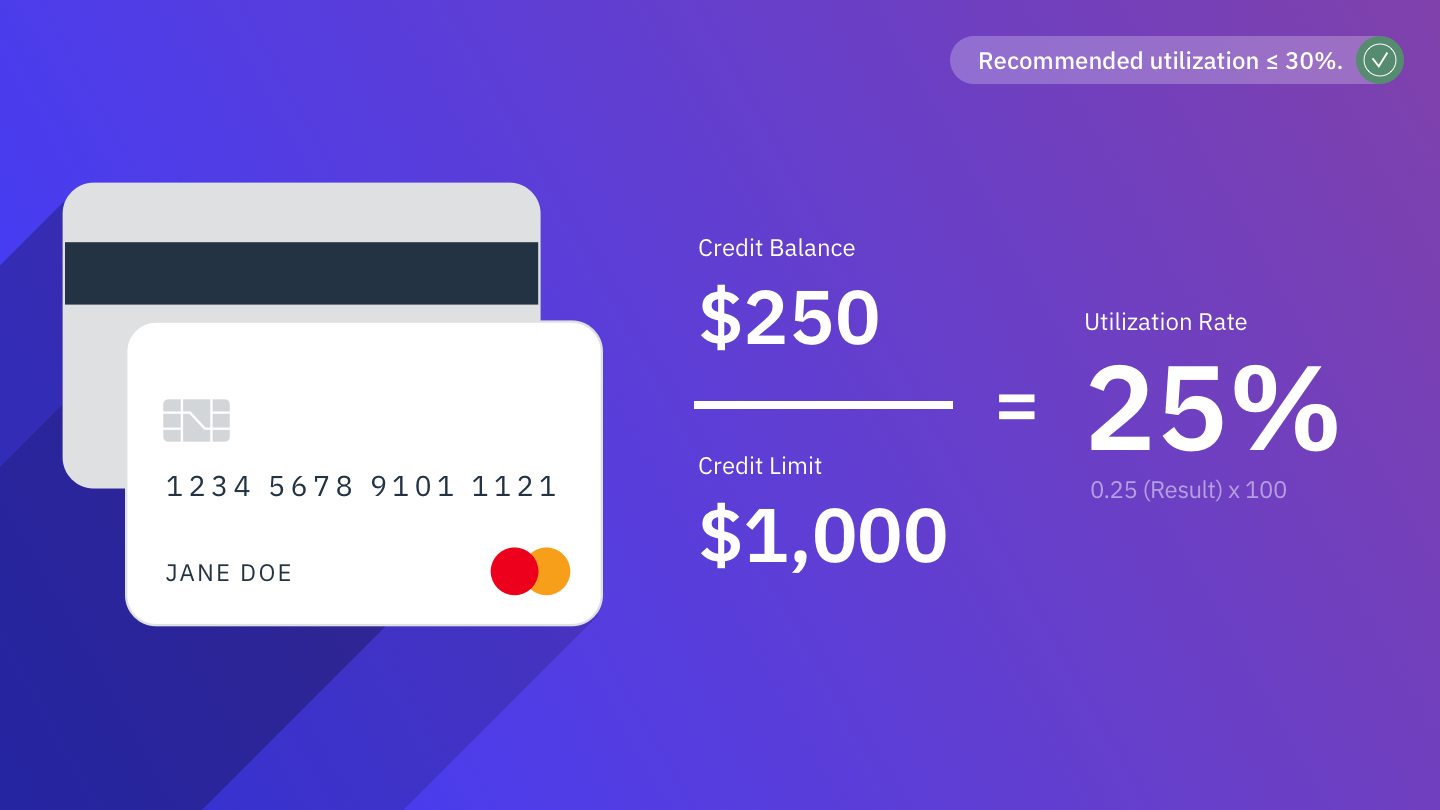

The formula for calculating credit utilization rate is:Credit Utilization Rate = (Total Outstanding Balance / Total Available Credit) x 100%

Types of Credit Accounts Included in the Calculation

All types of credit accounts are included in the calculation of your credit utilization rate, including credit cards, personal loans, and mortgages. However, some lenders may only consider revolving credit accounts, such as credit cards, when calculating your credit utilization rate.

Impact on Credit Score

The credit utilization rate is a significant factor in determining an individual’s credit score. A high credit utilization rate can negatively impact a credit score, while a low utilization rate can positively impact it.

Credit utilization rate is a measure of how much credit you are using compared to the amount of credit available to you. A high credit utilization rate indicates that you are using a large portion of your available credit, which can make lenders view you as a risky borrower.

This can lead to a lower credit score, which can make it more difficult to qualify for loans and other forms of credit at favorable interest rates.

High Credit Utilization Rate

A high credit utilization rate can significantly lower your credit score. Lenders see a high credit utilization rate as a sign that you may be overextended and struggling to manage your debt. This can make them less likely to approve you for loans or credit cards, or they may offer you less favorable terms.

Low Credit Utilization Rate

On the other hand, a low credit utilization rate can help you improve your credit score. Lenders see a low credit utilization rate as a sign that you are managing your debt responsibly and that you are not overextended. This can make them more likely to approve you for loans and credit cards, and they may offer you more favorable terms.

Optimal Credit Utilization Rate

Maintaining an optimal credit utilization rate is crucial for preserving a healthy credit score. The ideal range varies based on individual credit history and other factors.

Generally, a low credit utilization rate is recommended to maximize credit scores. Experts suggest keeping it below 30% of the total available credit limit. This demonstrates responsible credit management and reduces concerns about over-reliance on debt.

Optimal Credit Utilization Rate for Different Credit History Ranges

The optimal credit utilization rate can vary depending on the individual’s credit history. Here’s a table summarizing the recommended ranges:

| Credit History Range | Optimal Credit Utilization Rate |

|---|---|

| Excellent (750+ FICO) | <10% |

| Good (670-749 FICO) | <15% |

| Fair (580-669 FICO) | <20% |

| Poor (below 580 FICO) | <25% |

“Maintaining a low credit utilization rate is essential for building and maintaining a strong credit score. It shows lenders that you are using credit responsibly and are not overextending yourself financially.”– Experian

Monitoring Credit Utilization

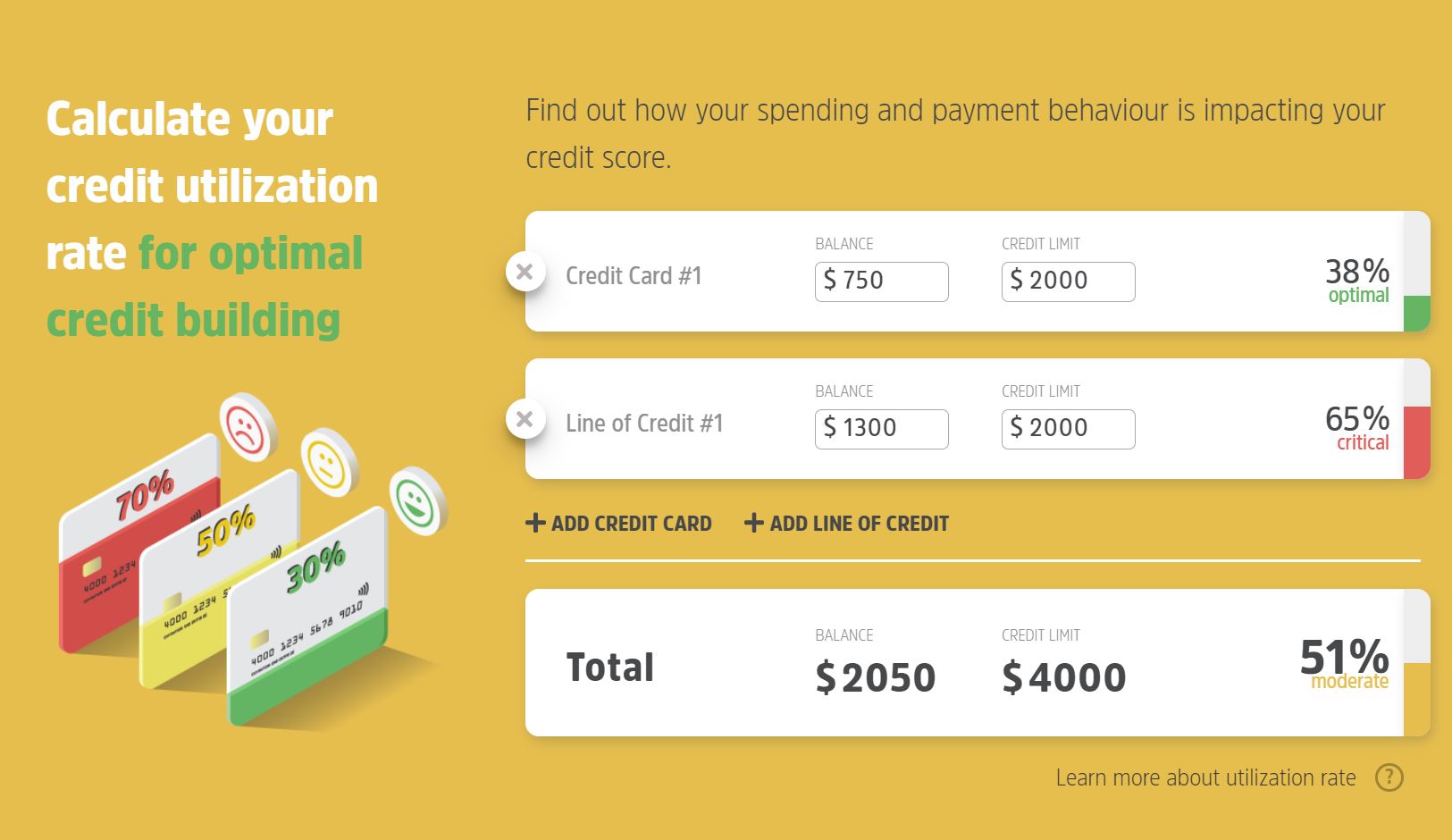

Regularly monitoring your credit utilization rate is crucial for maintaining a healthy credit profile. Several methods can be employed to track your credit utilization effectively.

Automated Tools

- Many banks and credit card companies offer online tools that provide real-time updates on your credit utilization rate.

- These tools allow you to view your current balances, available credit, and credit utilization percentage.

Manual Calculations

You can also calculate your credit utilization rate manually by dividing your total credit card balances by your total available credit.

Credit Utilization Rate = (Total Credit Card Balances / Total Available Credit) x 100%

It’s important to note that this method may not be as up-to-date as automated tools.

Credit Monitoring Services

Credit monitoring services provide comprehensive reports that include your credit utilization rate.

- These services typically charge a monthly fee but offer detailed insights into your credit profile.

- They can also alert you to any changes in your credit utilization rate or other factors that may affect your credit score.

Regardless of the method you choose, it’s essential to ensure timely updates and accuracy in your credit utilization monitoring.

- Outdated information can lead to inaccurate credit scores.

- To ensure timely updates, set up automatic alerts or regularly check your credit reports.

- For accuracy, compare the information provided by different sources and report any discrepancies to the relevant credit bureaus.

Managing Credit Utilization

Managing credit utilization is crucial for maintaining a healthy credit score. Here are some strategies to effectively manage your credit utilization rate:

Reducing High Utilization

- Pay down balances:Prioritize paying off high-balance credit cards to reduce your overall utilization rate.

- Request credit limit increases:Contact your credit card issuers and request credit limit increases. This will increase your available credit and lower your utilization rate.

- Avoid unnecessary spending:Monitor your spending and limit purchases to essential expenses. This will help you avoid accumulating high balances.

Optimizing Usage

- Keep balances below 30%:Aim to maintain a credit utilization rate below 30% to positively impact your credit score.

- Use multiple credit cards:Having multiple credit cards with low balances can help you stay within the optimal utilization range.

- Monitor credit reports regularly:Track your credit utilization rate and overall credit score by obtaining free credit reports from annualcreditreport.com.

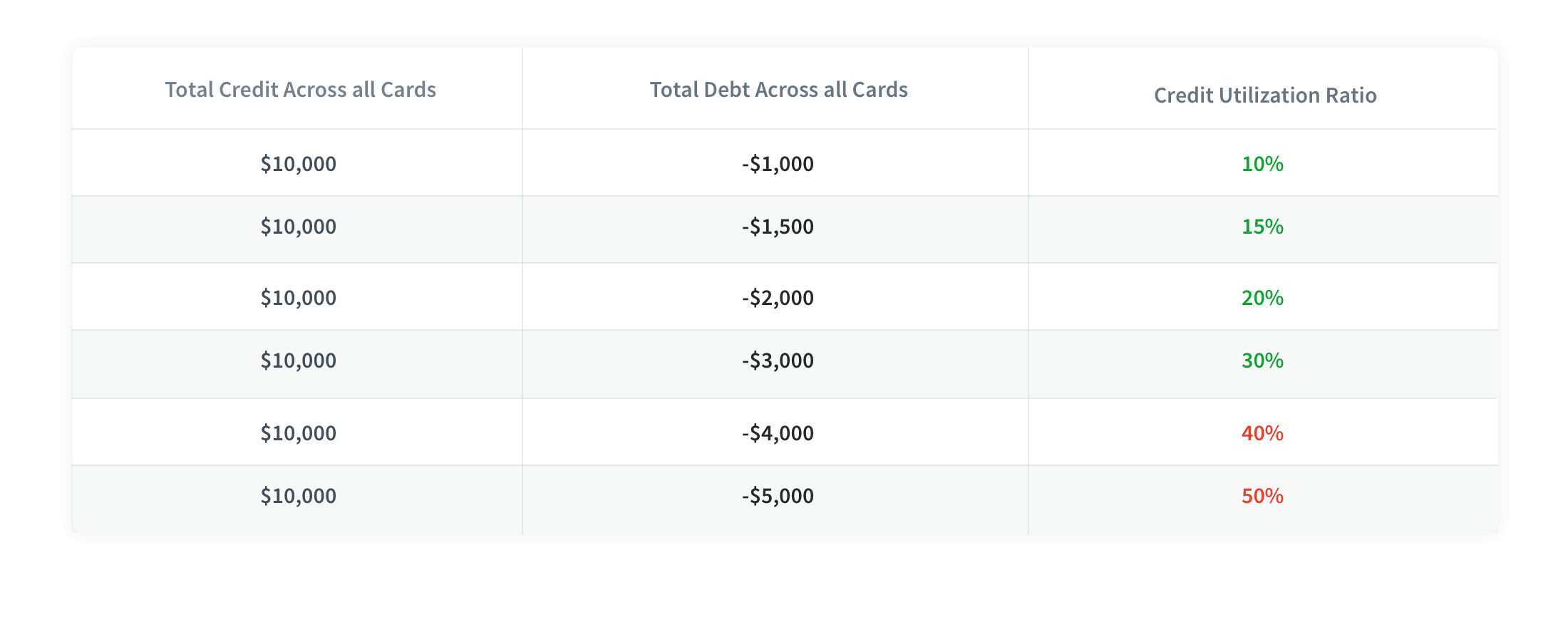

Credit Utilization Rate and Credit Limits

Credit limits significantly impact credit utilization rate. A higher credit limit provides more available credit, leading to a lower utilization rate if the same amount of debt is carried. Conversely, a lower credit limit can result in a higher utilization rate for the same debt balance.

Increasing Credit Limits

Increasing credit limits can be a strategic move to improve credit utilization rate. When a credit card issuer raises the credit limit, it increases the amount of available credit without affecting the outstanding balance. This effectively lowers the credit utilization rate, potentially boosting the credit score.

However, it’s important to use increased credit limits responsibly. Overspending or carrying a high balance can negate the benefits and potentially harm the credit score.

Impact on Loan Applications: What Is A Credit Utilization Rate

Your credit utilization rate is a crucial factor that lenders consider when evaluating your loan applications. It plays a significant role in determining your loan approval and the interest rates you qualify for.

A high credit utilization rate, typically above 30%, can negatively impact your loan application. It indicates to lenders that you are heavily utilizing your available credit, which raises concerns about your ability to manage debt and make timely payments. As a result, you may face difficulties getting approved for a loan or may qualify for less favorable terms, such as higher interest rates and lower loan amounts.

Example

For instance, let’s say you have a credit limit of $10,000 and a balance of $6,000. Your credit utilization rate would be 60%, which is considered high. If you apply for a loan with this credit utilization rate, you are more likely to be denied or receive a loan with a higher interest rate compared to someone with a lower credit utilization rate, such as 20%.

On the other hand, maintaining a low credit utilization rate, typically below 30%, can improve your chances of loan approval and qualify you for more favorable loan terms. It demonstrates to lenders that you are using your credit responsibly and have a good track record of managing debt.

As a result, you are more likely to get approved for a loan with a lower interest rate and a higher loan amount.

Statistics

According to Experian, a leading credit bureau, consumers with a credit utilization rate of less than 30% have a 98% approval rate for loans, while those with a credit utilization rate above 50% have an approval rate of only 65%.

Therefore, it is essential to monitor and manage your credit utilization rate to ensure that you are presenting yourself as a low-risk borrower and increasing your chances of loan approval with favorable terms.

Credit Utilization Rate and Credit Card Rewards

Credit utilization rate plays a significant role in determining credit card rewards. By optimizing utilization, cardholders can maximize the rewards they earn.

Rewards programs often offer tiered rewards based on spending levels. By keeping utilization low, cardholders can qualify for higher tiers, which typically offer more generous rewards, such as increased cash back, points, or miles.

Additionally, some credit card issuers offer bonus rewards for specific categories, such as travel or dining. By strategically using cards with these bonus categories, cardholders can further maximize their rewards earnings.

Explain how credit utilization rate affects credit card debt, including how it can impact credit score and interest rates.

Credit utilization rate, a crucial factor in determining creditworthiness, plays a significant role in managing credit card debt. It measures the percentage of your total available credit that you’re using. A high credit utilization rate can negatively impact your credit score and lead to higher interest rates on your credit cards and other loans.

Impact on Credit Score

Credit utilization rate is a key component of your credit score, typically accounting for 30% of the FICO score. A high credit utilization rate indicates to lenders that you may be overextending yourself financially and are at a higher risk of default.

This can result in a lower credit score, making it more difficult to qualify for loans and credit cards in the future.

Impact on Interest Rates

In addition to affecting your credit score, a high credit utilization rate can also lead to higher interest rates on your credit cards and other loans. When you have a high credit utilization rate, lenders view you as a riskier borrower and charge you higher interest rates to compensate for the increased risk.

This can make it more expensive to carry credit card debt and can lead to a vicious cycle of debt.

Example

For example, if you have a credit card with a $10,000 limit and a balance of $5,000, your credit utilization rate is 50%. This is considered a high credit utilization rate and could negatively impact your credit score and lead to higher interest rates.

– Elaborate on the importance of credit utilization rate in financial planning.

Credit utilization rate (CUR) plays a crucial role in financial planning as it directly impacts an individual’s credit score and overall financial health. A high CUR can significantly hinder financial progress, while a low CUR can contribute to financial stability and growth.

A credit utilization rate is a measure of how much of your available credit you are using. It is calculated by dividing your total credit card balances by your total credit limits. A high credit utilization rate can damage your credit score, so it is important to keep it low.

For more information on how to use a credit card responsibly, please refer to the guide on how to use gmei utility. A low credit utilization rate will help you maintain a good credit score, which can save you money on interest and fees.

CUR measures the amount of available credit being used compared to the total credit limit. A higher CUR indicates that an individual is using a significant portion of their available credit, which can raise concerns about their ability to manage debt effectively.

Lenders view a high CUR as a potential risk, as it suggests that the borrower may be overextended and struggling to keep up with payments.

Impact on overall financial health

A high CUR can negatively impact financial health in several ways. It can lead to higher interest rates on loans and credit cards, making it more expensive to borrow money. Additionally, a high CUR can make it difficult to qualify for new loans or credit cards, as lenders may view the individual as a high-risk borrower.

Strategies for maintaining a healthy credit utilization rate

To maintain a healthy CUR, it is important to use credit responsibly and avoid carrying large balances on credit cards. Individuals should aim to keep their CUR below 30%, and ideally below 10%. This can be achieved by paying down credit card balances regularly, avoiding unnecessary purchases, and increasing credit limits if necessary.

Examples of how a high credit utilization rate can negatively impact financial well-being

- Higher interest rates on loans and credit cards

- Difficulty qualifying for new loans or credit cards

- Increased risk of debt consolidation or bankruptcy

Table summarizing the benefits of maintaining a low credit utilization rate

| Benefit | Explanation |

|---|---|

| Lower interest rates on loans and credit cards | Lenders view individuals with low CURs as lower-risk borrowers, which can result in more favorable interest rates. |

| Increased chances of qualifying for new loans or credit cards | A low CUR indicates responsible credit management, making individuals more attractive to lenders. |

| Improved credit score | A low CUR is a key factor in determining credit scores, and maintaining a low CUR can help improve overall creditworthiness. |

| Reduced risk of debt problems | Individuals with low CURs are less likely to overextend themselves financially and face debt-related issues. |

Tips for reducing credit utilization rate, What is a credit utilization rate

- Pay down credit card balances regularly

- Avoid unnecessary purchases

- Increase credit limits if necessary

- Consider using a balance transfer credit card to consolidate debt

- Seek professional financial advice if struggling to manage debt

Credit Utilization Rate and Debt Consolidation

Credit utilization rate plays a crucial role in debt consolidation. When consolidating debt, you combine multiple debts into a single loan, typically with a lower interest rate. This can simplify debt management and potentially save money on interest payments. However, the credit utilization rate on the new loan is a critical factor to consider.

Consolidating debt can affect your utilization rate in two ways:

Impact on Utilization

- Decreased utilization:If the new loan has a higher credit limit than the combined balances of the previous debts, your credit utilization rate will decrease. This is beneficial as it lowers the percentage of available credit you are using, which can improve your credit score.

- Increased utilization:If the new loan has a lower credit limit than the combined balances of the previous debts, your credit utilization rate will increase. This can negatively impact your credit score and potentially lead to higher interest rates on future loans.

Credit Utilization Rate and Credit Repair

Credit utilization rate is a crucial factor in credit repair. High credit utilization can negatively impact credit scores, making it more challenging to qualify for loans and other forms of credit. Conversely, reducing credit utilization can significantly improve credit scores and enhance overall financial well-being.

A credit utilization rate, a percentage that shows how much of your available credit you’re using, is an important factor in your credit score. It can affect your ability to get loans and credit cards, as well as the interest rates you’re offered.

Which statement describes the law of diminishing marginal utility ? It states that as you consume more of a good or service, the additional satisfaction you get from each additional unit decreases.

Strategies for Reducing Credit Utilization

To reduce credit utilization, individuals can employ several strategies:

- Pay Down Balances:Paying down outstanding credit card balances is the most effective way to reduce credit utilization. Prioritizing high-interest debts can save money on interest charges while improving credit scores.

- Request Credit Limit Increases:Contacting credit card issuers to request credit limit increases can lower credit utilization without affecting total debt. However, it’s essential to use the additional credit responsibly to avoid increasing debt.

Impact of Reducing Credit Utilization on Credit Scores

Reducing credit utilization has a positive impact on credit scores. The table below illustrates the relationship between credit utilization rate and credit score impact:

| Credit Utilization Rate | Credit Score Impact |

|---|---|

| 0-10% | Positive impact |

| 10-30% | Neutral impact |

| 30-50% | Negative impact |

| Over 50% | Significant negative impact |

Tips for Improving Credit Utilization Rate

- Monitor credit utilization regularly.

- Pay down balances strategically, focusing on high-interest debts first.

- Request credit limit increases only when necessary.

- Avoid opening multiple new credit accounts in a short period.

- Dispute any errors on credit reports.

By implementing these strategies, individuals can improve their credit utilization rate and enhance their overall creditworthiness.

Credit Utilization Rate and Credit Counseling

Credit utilization rate is a crucial aspect of credit counseling, as it plays a significant role in assessing an individual’s financial well-being and developing effective strategies for debt management.

Credit counselors analyze an individual’s credit utilization rate to identify potential areas of concern and provide guidance on how to manage it effectively. By understanding the impact of credit utilization on credit scores and loan applications, counselors can help individuals make informed decisions about their credit usage and avoid potential financial pitfalls.

Role of Credit Utilization Rate in Credit Counseling

- Assessing Financial Health:Credit utilization rate is a key indicator of an individual’s ability to manage credit responsibly. High credit utilization rates can signal financial stress and over-reliance on credit.

- Identifying Credit Issues:Credit counselors can use credit utilization rate to identify underlying credit issues, such as excessive spending or poor credit management practices.

- Developing Personalized Plans:Counselors create personalized credit management plans tailored to each individual’s unique circumstances, considering their credit utilization rate and other financial factors.

- Improving Credit Scores:Credit utilization rate is a major factor in calculating credit scores. Counselors provide guidance on reducing credit utilization and improving credit scores over time.

- Managing Debt:Counselors assist individuals in developing strategies to manage debt effectively, including reducing credit utilization and consolidating or restructuring debt.

– Describe how credit utilization rate is calculated and its impact on credit score.

Credit utilization rate (CUR) is a measure of how much credit you are using compared to your total available credit. It is calculated by dividing your total outstanding balance by your total credit limit. A high CUR can negatively impact your credit score, as it indicates that you are using too much of your available credit and may be at risk of default.

For example, if you have a total credit limit of $10,000 and a balance of $5,000, your CUR would be 50%. A CUR of 30% or less is considered good, while a CUR of 50% or more is considered high.

Your CUR is a significant factor in your credit score, as it accounts for 30% of your FICO score. A high CUR can lower your score, making it more difficult to qualify for loans and other forms of credit. It can also lead to higher interest rates on new loans.

Essential Questionnaire

What is a good credit utilization rate?

Generally, a credit utilization rate below 30% is considered good and helps maintain a healthy credit score.

How is credit utilization rate calculated?

Credit utilization rate is calculated by dividing your total outstanding credit balances by your total available credit limits.

How does credit utilization rate affect my credit score?

High credit utilization rates can negatively impact your credit score, as they indicate to lenders that you may be overextending yourself financially.

What are some strategies for managing credit utilization rate?

To manage your credit utilization rate effectively, consider paying down balances, requesting credit limit increases, and avoiding unnecessary spending.