How much do utility companies pay for easements? This question often arises when utility companies seek to acquire easements on private property for the installation and maintenance of their infrastructure. Determining fair compensation for easements is a complex process that involves various factors, legal frameworks, and negotiation strategies.

This presentation aims to provide a comprehensive guide to understanding how utility companies determine compensation for easements, the factors that influence compensation, and best practices for landowners and utility companies.

Industry Standards and Regulations

The legal frameworks and industry practices governing easement compensation for utility companies are complex and vary across jurisdictions. These frameworks aim to ensure that landowners are fairly compensated for the use of their property and that utility companies can acquire the necessary easements to provide essential services.

Government agencies and utility commissions play a crucial role in establishing regulations and guidelines for easement compensation. These regulations typically set forth minimum compensation standards, procedures for negotiating easements, and dispute resolution mechanisms.

Professional Organizations and Industry Groups

Professional organizations and industry groups also contribute to the development of standards for easement compensation. These organizations provide guidance to their members on best practices, conduct research on valuation methodologies, and advocate for fair compensation for landowners.

Recent Legal Cases and Court Decisions

Recent legal cases and court decisions have further shaped the legal landscape for easement compensation. These cases have clarified the interpretation of existing regulations, established new precedents, and provided guidance on the factors to be considered in determining fair compensation.

Factors Influencing Compensation

The amount of compensation paid for easements is determined by several key factors, including land type and usage, easement location and size, term of the easement, and impact on property value.

Land Type and Usage

The type of land and its current usage can significantly influence compensation. Agricultural land, for example, typically receives lower compensation than residential or commercial land. This is because agricultural land is generally less valuable than other types of land.

Easement Location and Size

The location and size of the easement can also affect compensation. Easements that are located in highly visible or desirable areas may receive higher compensation. Additionally, larger easements typically receive higher compensation than smaller easements.

Term of the Easement

The term of the easement, whether it is permanent or temporary, can also impact compensation. Permanent easements typically receive higher compensation than temporary easements. This is because permanent easements give the utility company a permanent right to use the land, while temporary easements only give the utility company a right to use the land for a specific period of time.

Impact on Property Value

The impact of the easement on the property value can also influence compensation. Easements that have a significant impact on property value may receive higher compensation. This is because the easement may reduce the value of the property, and the utility company is responsible for compensating the landowner for this loss.

| Factor | Potential Impact on Compensation |

|---|---|

| Land type and usage | Agricultural land typically receives lower compensation than residential or commercial land. |

| Easement location and size | Easements that are located in highly visible or desirable areas may receive higher compensation. |

| Term of the easement | Permanent easements typically receive higher compensation than temporary easements. |

| Impact on property value | Easements that have a significant impact on property value may receive higher compensation. |

Summary

In summary, the amount of compensation paid for easements is influenced by several key factors, including land type and usage, easement location and size, term of the easement, and impact on property value. These factors should be carefully considered when negotiating compensation for an easement.

Negotiation and Appraisal

Negotiation and appraisal are crucial steps in determining fair compensation for easements. This process involves collaboration between landowners and utility companies, each with specific roles and responsibilities.

Roles and Responsibilities

- Landowners:Disclose property ownership, negotiate compensation, and provide access for appraisals.

- Utility Companies:Initiate easement requests, determine easement needs, and offer compensation.

Techniques for Determining Fair Compensation

Several techniques are used to determine fair compensation, including:

- Comparable Sales Analysis:Comparing recent sales of similar properties with easements.

- Income Approach:Estimating the potential loss of income due to the easement.

- Cost Approach:Determining the cost of replacing the property’s functionality lost due to the easement.

Appraisal Methods

Appraisal methods are used to assess property value and determine fair compensation. Common methods include:

- Fee Simple Appraisal:Assesses the value of the entire property, including the portion affected by the easement.

- Easement Appraisal:Assesses the value of the portion of the property taken by the easement.

- Before-and-After Appraisal:Compares the property’s value before and after the easement is granted.

Types of Compensation

Utility companies offer various types of compensation for easements, each with its advantages and disadvantages. Understanding these options is crucial for landowners when negotiating an easement agreement.

Lump Sum Payments

Lump sum payments are one-time payments made to the landowner in exchange for the easement. This type of compensation is straightforward and easy to administer, but it may not always reflect the long-term value of the easement.

Periodic Payments

Periodic payments involve regular payments made to the landowner over the life of the easement. This option provides ongoing compensation but can be more complex to administer than lump sum payments.

In-Kind Benefits

In-kind benefits are non-monetary forms of compensation, such as access to utilities or other services provided by the utility company. This type of compensation can be valuable for landowners who may benefit from the presence of the easement.

Tax Implications

Easement compensation can have significant tax implications for both landowners and utility companies. It’s crucial to understand these implications to ensure compliance and minimize tax liability.

Federal and State Tax Laws

The tax treatment of easement compensation varies depending on federal and state tax laws. Generally, compensation received for granting an easement is considered income and is taxed accordingly. However, there may be exceptions and deductions available, depending on the specific circumstances and type of easement.

Treatment of Compensation

The compensation received for an easement can be treated as either ordinary income or capital gains. Ordinary income is taxed at the taxpayer’s regular income tax rate, while capital gains are taxed at a lower rate. The treatment of compensation depends on factors such as the landowner’s holding period for the property and the purpose of the easement.

Reporting Requirements

Landowners and utility companies are required to report easement compensation on their tax returns. Landowners must report the compensation as income, while utility companies must report it as a deduction. Specific reporting requirements may vary depending on the type of easement and the tax laws of the relevant jurisdiction.

Tax Benefits and Deductions

In certain cases, landowners may be eligible for tax benefits or deductions related to easement compensation. For example, conservation easements may qualify for tax deductions under federal and state laws. Additionally, landowners may be able to reduce their property taxes by deducting the value of the easement from their property’s assessed value.

Tax Implications of Different Easement Types

The tax implications of easement compensation can vary depending on the type of easement granted. Conservation easements, which are designed to protect natural resources or historic landmarks, may have different tax treatment than utility easements, which grant rights to utility companies to use the property for specific purposes.

Strategies for Minimizing Tax Liability

There are several strategies that landowners and utility companies can employ to minimize their tax liability related to easement compensation. These strategies may include:

- Understanding the tax laws and seeking professional advice

- Negotiating the terms of the easement to minimize taxable income

- Exploring tax deductions and benefits available for specific types of easements

- Considering the long-term tax implications of granting an easement

Easement Documentation

Proper documentation of easements is crucial to ensure the rights and obligations of both the utility company and the landowner are clearly defined and legally enforceable. This documentation includes:

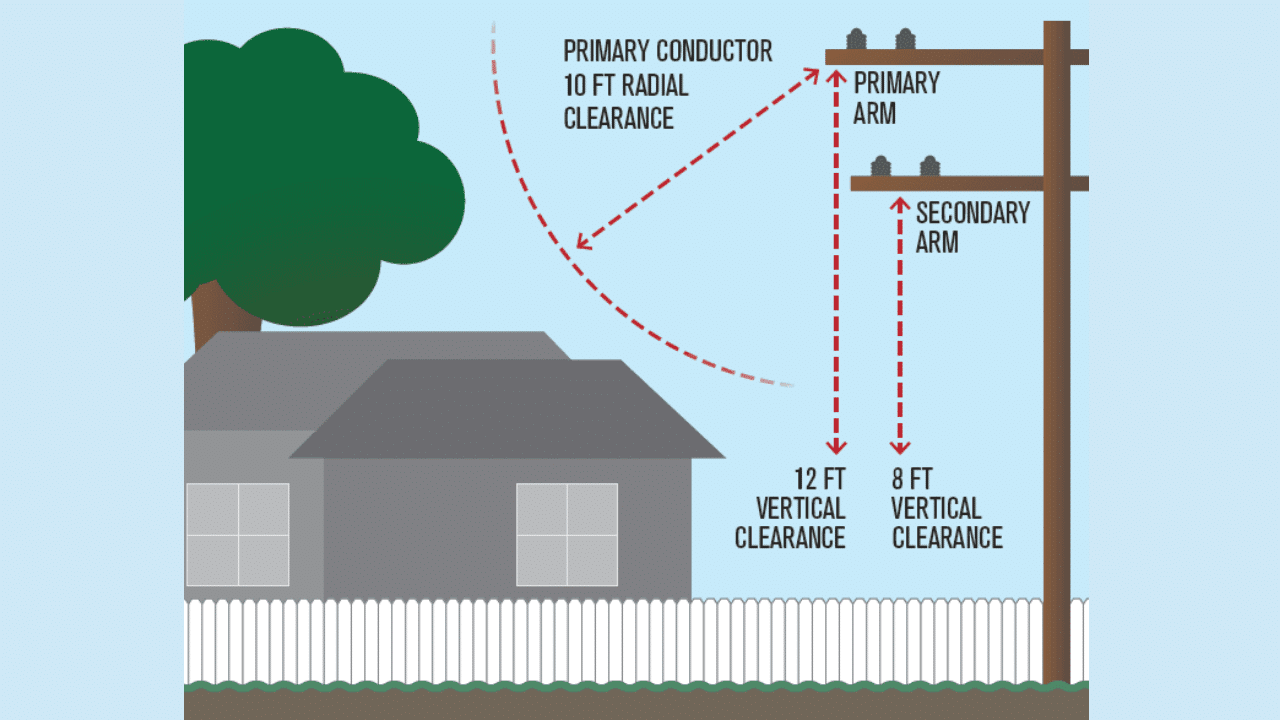

Legal Descriptions and Surveys

Legal descriptions provide a precise description of the location and boundaries of the easement, while surveys create a map or diagram that visually represents the easement’s location. These documents are essential for identifying the specific area where the utility company has the right to access and use the land.

Easement Agreements and Contracts

Easement agreements are legal contracts that establish the terms and conditions of the easement, including the scope of the utility company’s rights, the duration of the easement, and any compensation or other considerations provided to the landowner. These agreements should be carefully drafted to ensure they are clear, comprehensive, and legally binding.

Recording Requirements

Recording the easement agreement with the appropriate government agency, such as the county recorder’s office, provides public notice of the easement and protects the utility company’s rights against subsequent claims by third parties. Recording requirements vary by jurisdiction, so it is important to consult with legal counsel to ensure compliance.

Case Studies and Examples

Real-world easement negotiations and compensation agreements provide valuable insights into the factors influencing compensation amounts and the negotiation process. Here are a few case studies and examples:

Compensation for a Pipeline Easement

In a case involving a pipeline easement across a large agricultural property, the landowner initially demanded $1 million in compensation. The utility company countered with an offer of $500,000. After negotiations, the parties agreed on a compensation amount of $750,000.

Factors that influenced the compensation included the size of the easement, the duration of the easement, the impact on the landowner’s farming operations, and the potential for future development of the property.

Compensation for a Transmission Line Easement

In another case, a utility company sought to acquire an easement for a transmission line across a residential neighborhood. The homeowners initially resisted, concerned about the potential impact on their property values. After extensive negotiations, the utility company agreed to bury the transmission lines underground and to pay each homeowner $10,000 in compensation.

Factors that influenced the compensation included the visibility of the transmission lines, the potential for electromagnetic interference, and the impact on the homeowners’ quality of life.

Best Practices for Utility Companies

Utility companies should adopt best practices when acquiring easements to ensure fair and transparent transactions. These practices foster positive relationships with landowners and promote efficient project execution.

Building Relationships with Landowners

Establishing strong relationships with landowners is crucial. Utility companies should:

- Engage landowners early in the process to understand their concerns and needs.

- Foster open communication and actively listen to landowners’ perspectives.

- Respect landowners’ property rights and minimize disruptions during easement construction.

Communicating Openly and Transparently

Clear and transparent communication is essential. Utility companies should:

- Provide landowners with comprehensive information about the easement, its purpose, and its potential impacts.

- Use plain language and avoid technical jargon to ensure understanding.

- Address landowners’ questions and concerns promptly and honestly.

Offering Fair Compensation

Offering fair compensation is a cornerstone of ethical easement acquisition. Utility companies should:

- Conduct thorough appraisals to determine the value of the easement.

- Consider the landowner’s loss of property rights and potential future development opportunities.

- Negotiate in good faith and be willing to compromise to reach a mutually acceptable agreement.

Provide best practices for landowners when negotiating easements with utility companies, including:

Negotiating easements with utility companies can be a complex process. Landowners should be aware of their rights and options, seek professional advice, consider long-term impacts, understand the different types of easements, and negotiate a fair compensation package.

By following these best practices, landowners can protect their property rights and ensure that they receive fair compensation for the use of their land.

Understanding their rights and options

Landowners should understand their rights and options before negotiating an easement with a utility company. This includes understanding the legal requirements for easements, the different types of easements, and the potential impacts of an easement on their property.

Seeking professional advice

Landowners may want to consider seeking professional advice from an attorney or land use planner before negotiating an easement with a utility company. A professional can help landowners understand their rights and options, and can negotiate on their behalf to ensure that they receive fair compensation.

Considering long-term impacts

Landowners should consider the long-term impacts of an easement before agreeing to it. This includes considering how the easement will affect their use of the property, the value of the property, and the potential for future development.

Understanding the different types of easements

There are different types of easements, each with its own specific terms and conditions. Landowners should understand the different types of easements before negotiating an easement with a utility company.

Negotiating a fair compensation package

Landowners should negotiate a fair compensation package for the use of their land. This includes negotiating the amount of compensation, the terms of the easement, and any other benefits that the landowner may receive.

Protecting their property rights, How much do utility companies pay for easements

Landowners should protect their property rights by ensuring that the easement is properly documented and recorded. This will help to prevent the utility company from taking advantage of the landowner or from using the easement for purposes that were not agreed to.

Alternative Dispute Resolution

Alternative dispute resolution (ADR) methods provide a non-adversarial and often less expensive approach to resolving easement disputes outside of court. These methods aim to facilitate communication and negotiation between utility companies and landowners.

The most common ADR methods for easement disputes include:

Mediation

- A neutral third-party mediator assists the parties in reaching a mutually acceptable agreement.

- Mediation is a voluntary process, and the mediator has no decision-making authority.

- It is often used in cases where the parties have a pre-existing relationship or are interested in preserving it.

Arbitration

- A neutral third-party arbitrator hears evidence and makes a binding decision on the dispute.

- Arbitration is less formal than litigation and can be more efficient and cost-effective.

- However, the decision of the arbitrator is final and binding, and there is limited scope for appeal.

Litigation

- A court hears evidence and makes a decision on the dispute.

- Litigation is the most adversarial and expensive form of ADR.

- It is typically used when other ADR methods have failed or when the parties are unable to reach an agreement.

Environmental Considerations

Easements can have significant environmental implications, and it is essential for utility companies and landowners to consider these impacts during the negotiation process.

Impact on Natural Resources

Easements can disrupt natural habitats, fragment ecosystems, and affect the movement of wildlife. Utility companies must assess the potential impacts on natural resources and develop mitigation measures to minimize these effects.

Mitigation Measures and Restoration Plans

Mitigation measures may include restoring disturbed areas, creating wildlife corridors, and implementing erosion control measures. Restoration plans should Artikel the steps to be taken to restore the environment to its pre-construction condition.

Best Practices for Avoiding or Minimizing Environmental Impacts

* Conduct thorough environmental assessments before construction.

- Design easements to minimize disruption to natural resources.

- Use environmentally friendly construction techniques.

- Implement erosion control measures and revegetate disturbed areas.

- Monitor the easement area for environmental impacts and take corrective actions as needed.

Regulatory Requirements and Permits

Utility companies must comply with all applicable environmental regulations and obtain necessary permits before constructing easements. These regulations may include the Endangered Species Act, the Clean Water Act, and the National Environmental Policy Act.

Long-Term Monitoring and Maintenance Plans

Long-term monitoring and maintenance plans should be developed to ensure that the easement area is maintained in a safe and environmentally sound condition. This may include monitoring for erosion, invasive species, and wildlife impacts.

Future Trends and Developments

The landscape of easement compensation for utility companies is constantly evolving, driven by technological advancements, regulatory changes, and shifting economic and political factors. Understanding these emerging trends and their potential impact is crucial for utility companies to adapt and navigate the future successfully.

Technology in Negotiations

Technology is transforming the way easement negotiations are conducted. Virtual reality and augmented reality tools allow for immersive site visualization, enhancing understanding and communication between parties. Data analytics and machine learning algorithms can analyze historical data and predict compensation trends, providing valuable insights for both utility companies and landowners.

Regulatory Frameworks

Regulatory frameworks governing easement compensation are constantly evolving. New laws and regulations may impose additional requirements or restrictions on utility companies, affecting the negotiation process and compensation amounts. Staying abreast of these changes is essential to ensure compliance and avoid legal challenges.

Economic and Political Factors

Economic conditions and political policies can significantly influence easement compensation. Fluctuations in interest rates, inflation, and economic growth can impact the value of land and the willingness of landowners to grant easements. Political priorities and government incentives can also shape the negotiation process.

The cost of easements for utility companies varies depending on factors such as location and negotiation. Once acquired, these easements typically remain in effect for the life of the utility infrastructure, potentially affecting the value of the underlying property. However, the length of time that utility bills should be kept for tax purposes or other legal reasons varies depending on jurisdiction.

For example, in some areas, utility bills may need to be retained for several years to support claims for deductions or rebates. Understanding these timelines can help property owners navigate easement negotiations and manage their financial obligations related to utility services.

Environmental Concerns

Environmental concerns are becoming increasingly prominent in easement negotiations. Utility companies must consider the potential environmental impact of their projects and incorporate measures to mitigate any adverse effects. This can lead to additional compensation for landowners who agree to easements that involve sensitive environmental areas.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are emerging as powerful tools for easement compensation. AI-powered algorithms can analyze vast amounts of data, identify patterns, and predict compensation trends. ML models can automate certain aspects of the negotiation process, saving time and resources.

Legal Theories and Case Law

Legal theories and case law continue to shape easement compensation. New legal doctrines and court rulings can establish precedents that influence the negotiation process and the interpretation of easement agreements. Staying informed about these developments is crucial to avoid legal pitfalls and ensure fair compensation.

Comparison of Compensation Models

Utility companies employ various compensation models to remunerate landowners for easements, each with distinct characteristics, advantages, and disadvantages.

Lump Sum Payments

A lump sum payment is a one-time, upfront payment made to the landowner upon granting the easement. This model offers:

- Advantages:Simplicity, immediate financial gain for the landowner, and reduced ongoing administrative costs for the utility company.

- Disadvantages:Potential undervaluation of the easement, lack of flexibility to accommodate future changes, and difficulty in accounting for inflation.

Examples: Southern California Edison, Pacific Gas and Electric Company

The amount that utility companies pay for easements can vary widely depending on a number of factors, including the location of the easement, the size of the easement, and the type of easement. However, as the law of diminishing marginal utility suggests, the value of each additional easement decreases as the number of easements increases.

This is because the marginal benefit of each additional easement is less than the marginal benefit of the previous easement. As a result, utility companies are typically willing to pay less for each additional easement that they acquire.

Periodic Payments

Periodic payments are made regularly over the term of the easement, providing a consistent income stream to the landowner. This model offers:

- Advantages:Predictable income, flexibility to adjust payments based on changes in land value or easement usage, and potential tax benefits.

- Disadvantages:Ongoing administrative costs for the utility company, potential disputes over payment amounts, and uncertainty regarding the total compensation over the easement’s term.

Examples: National Grid, Dominion Energy

Fixed Rates

Fixed rates establish a predetermined compensation amount for the easement, regardless of changes in land value or easement usage. This model offers:

- Advantages:Simplicity, certainty for both parties, and reduced negotiation costs.

- Disadvantages:Potential for undervaluation or overvaluation of the easement, lack of flexibility to accommodate future changes, and difficulty in accounting for inflation.

Examples: Duke Energy, American Electric Power

Negotiated Rates

Negotiated rates are determined through direct negotiations between the utility company and the landowner, considering factors such as land value, easement usage, and comparable market rates. This model offers:

- Advantages:Flexibility to tailor compensation to the specific circumstances of the easement, potential for higher compensation, and greater control over the negotiation process.

- Disadvantages:Time-consuming and potentially adversarial negotiation process, potential for disputes, and uncertainty regarding the final compensation amount.

Examples: Exelon, Eversource Energy

Time-of-Use Rates

Time-of-use rates vary the compensation amount based on the time of day or season when the easement is used. This model offers:

- Advantages:Potential for lower compensation during off-peak periods, flexibility to accommodate changes in easement usage, and incentives for landowners to minimize easement impact.

- Disadvantages:Complexity in implementation, potential for disputes over usage data, and difficulty in predicting compensation amounts.

Examples: San Diego Gas & Electric, Puget Sound Energy

Demand-Based Rates

Demand-based rates adjust compensation based on the amount of electricity or gas transported through the easement. This model offers:

- Advantages:Compensation tied directly to easement usage, potential for higher compensation during periods of high demand, and incentives for landowners to support infrastructure upgrades.

- Disadvantages:Complexity in implementation, potential for disputes over usage data, and difficulty in predicting compensation amounts.

Examples: Consolidated Edison, NextEra Energy

Performance-Based Incentives

Performance-based incentives reward landowners for exceeding certain performance metrics related to easement maintenance or environmental stewardship. This model offers:

- Advantages:Encourages responsible easement management, provides incentives for landowners to invest in easement maintenance, and promotes environmental protection.

- Disadvantages:Complexity in implementation, potential for disputes over performance metrics, and difficulty in quantifying compensation amounts.

Examples: Tennessee Valley Authority, Hydro One

Flat Rates

Flat rates establish a uniform compensation amount for all easements within a specific area or category. This model offers:

- Advantages:Simplicity, ease of implementation, and reduced negotiation costs.

- Disadvantages:Potential for undervaluation or overvaluation of individual easements, lack of flexibility to accommodate variations in easement characteristics, and difficulty in accounting for inflation.

Examples: Florida Power & Light, CenterPoint Energy

Summary and Recommendations

The choice of compensation model depends on various factors, including the specific circumstances of the easement, the utility company’s policies, and the landowner’s preferences. Utility companies should carefully consider the advantages and disadvantages of each model and select the one that best aligns with their objectives and the interests of landowners.

To ensure fair and equitable compensation, utility companies should:

- Provide clear and transparent information about the compensation models available.

- Engage in open and respectful negotiations with landowners.

- Consider the unique characteristics of each easement and the potential impact on the landowner’s property.

- Seek professional advice from appraisers and legal counsel when necessary.

Methods for Assessing Property Value

Comparable Sales Analysis

The comparable sales analysis method is a widely used technique for assessing the value of property affected by easements. It involves comparing the subject property to similar properties that have recently sold in the same market area. The comparable properties should be as similar as possible to the subject property in terms of size, location, amenities, and other relevant characteristics.

Factors considered in the comparable sales analysis include:

- Sale price of the comparable property

- Date of sale

- Location of the comparable property

- Size and configuration of the comparable property

- Amenities and features of the comparable property

The comparable sales analysis method is a relatively straightforward and objective method for assessing property value. However, it can be difficult to find truly comparable properties, and the method can be less reliable in markets with limited sales activity.

Cost Approach

The cost approach method estimates the value of property by adding up the cost of the land, the cost of constructing the improvements, and the cost of any depreciation. The cost of the land is typically determined by the comparable sales analysis method.

The cost of constructing the improvements is based on current construction costs and the size and configuration of the improvements. Depreciation is a deduction from the value of the improvements to account for their age and condition.

The cost approach method is a relatively conservative method for assessing property value. However, it can be difficult to accurately estimate the cost of constructing the improvements, and the method can be less reliable in markets with rapidly changing construction costs.

Income Approach

The income approach method estimates the value of property based on its income-generating potential. The method involves estimating the net operating income (NOI) of the property and then capitalizing the NOI to determine the property value. The NOI is calculated by subtracting the operating expenses from the gross income of the property.

The capitalization rate is a percentage that is used to convert the NOI into a property value.

The income approach method is a relatively sophisticated method for assessing property value. However, it can be difficult to accurately estimate the NOI and the capitalization rate, and the method can be less reliable in markets with uncertain income streams.

Advantages and Disadvantages of Each Method

Each of the three methods for assessing property value has its own advantages and disadvantages. The comparable sales analysis method is relatively straightforward and objective, but it can be difficult to find truly comparable properties. The cost approach method is relatively conservative, but it can be difficult to accurately estimate the cost of constructing the improvements.

The income approach method is relatively sophisticated, but it can be difficult to accurately estimate the NOI and the capitalization rate.

The best method for assessing property value in a particular case will depend on the specific circumstances. In general, the comparable sales analysis method is the most reliable method, but the cost approach method or the income approach method may be more appropriate in certain cases.

Design a Table Summarizing Compensation Ranges

To provide a comprehensive overview of compensation ranges paid for easements by utility companies, we have compiled a table summarizing data from various regions and jurisdictions. This table offers insights into the factors that influence compensation and the typical ranges landowners can expect to receive.

The table includes information on the following factors:

- Region or jurisdiction

- Type of easement (e.g., permanent, temporary, overhead, underground)

- Size of easement

- Land use (e.g., residential, commercial, agricultural)

- Compensation range

This table serves as a valuable resource for both landowners and utility companies engaged in easement negotiations. By understanding the compensation ranges in different areas, landowners can make informed decisions about the value of their property and negotiate fair compensation.

Utility companies, on the other hand, can use this information to develop reasonable offers and streamline the easement acquisition process.

Compensation Ranges

The following table summarizes the compensation ranges paid for easements by utility companies in different regions or jurisdictions:

| Region/Jurisdiction | Type of Easement | Size of Easement | Land Use | Compensation Range |

|---|---|---|---|---|

| California | Permanent | 1 acre | Residential | $20,000

|

| Texas | Temporary | 0.5 acres | Commercial | $10,000

|

| New York | Overhead | 100 feet | Agricultural | $5,000

|

| Florida | Underground | 50 feet | Residential | $3,000

|

Q&A: How Much Do Utility Companies Pay For Easements

What factors influence the amount of compensation paid for easements?

Factors influencing compensation include land type and usage, easement location and size, term of the easement, and impact on property value.

What are the different types of compensation that may be offered for easements?

Compensation may be offered as lump sum payments, periodic payments, or in-kind benefits such as access to utilities.

What are the tax implications of easement compensation for landowners and utility companies?

Compensation may be subject to federal and state income or capital gains taxes. Landowners may also be eligible for tax benefits or deductions.

What are best practices for landowners when negotiating easements with utility companies?

Landowners should understand their rights, seek professional advice, consider long-term impacts, and negotiate a fair compensation package that protects their property rights.